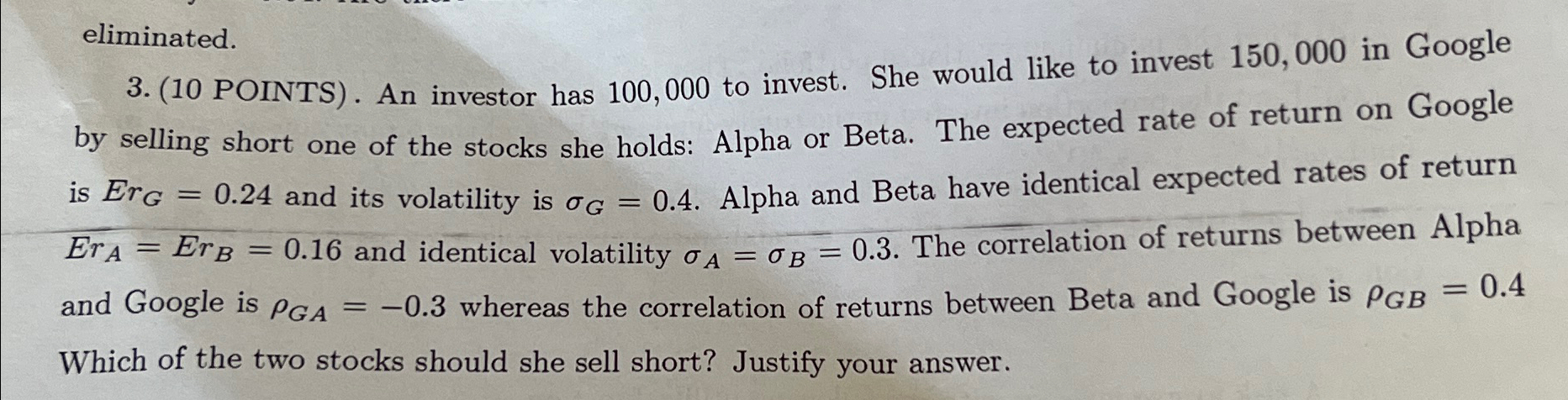

Question: 3 . ( 1 0 POINTS ) . An investor has 1 0 0 , 0 0 0 to invest. She would like to invest

POINTS An investor has to invest. She would like to invest in Google by selling short one of the stocks she holds: Alpha or Beta. The expected rate of return on Google is and its volatility is Alpha and Beta have identical expected rates of return and identical volatility The correlation of returns between Alpha and Google is whereas the correlation of returns between Beta and Google is Which of the two stocks should she sell short? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock