Question: # 3 ( 1 0 points ) InTech, a computer software firm that has never paid dividends before, is considering whether it should start doing

# points

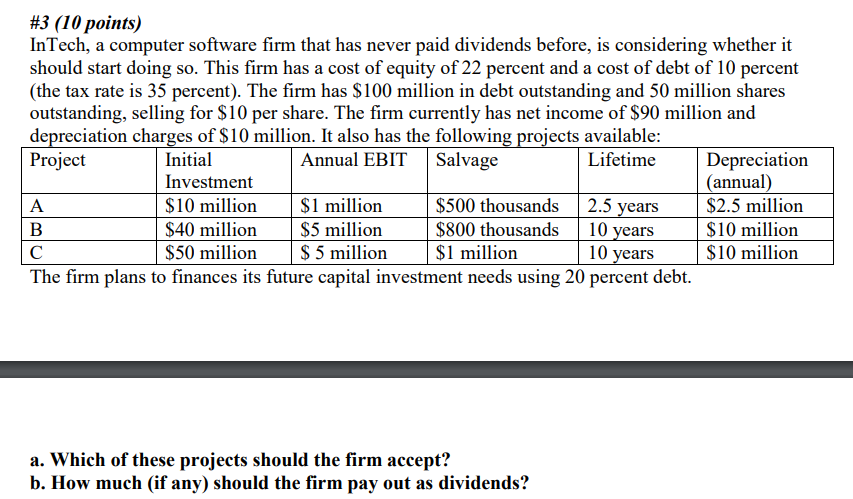

InTech, a computer software firm that has never paid dividends before, is considering whether it

should start doing so This firm has a cost of equity of percent and a cost of debt of percent

the tax rate is percent The firm has $ million in debt outstanding and million shares

outstanding, selling for $ per share. The firm currently has net income of $ million and

depreciation charges of $ million. It also has the following projects available:

The firm plans to finances its future capital investment needs using percent debt.

a Which of these projects should the firm accept?

b How much if any should the firm pay out as dividends?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock