Question: 3 - 1 2 . Research Case - Budgetary Comparison Statements; Budget Basis Compared with GAAP. ( LO 3 - 3 , LO 3 -

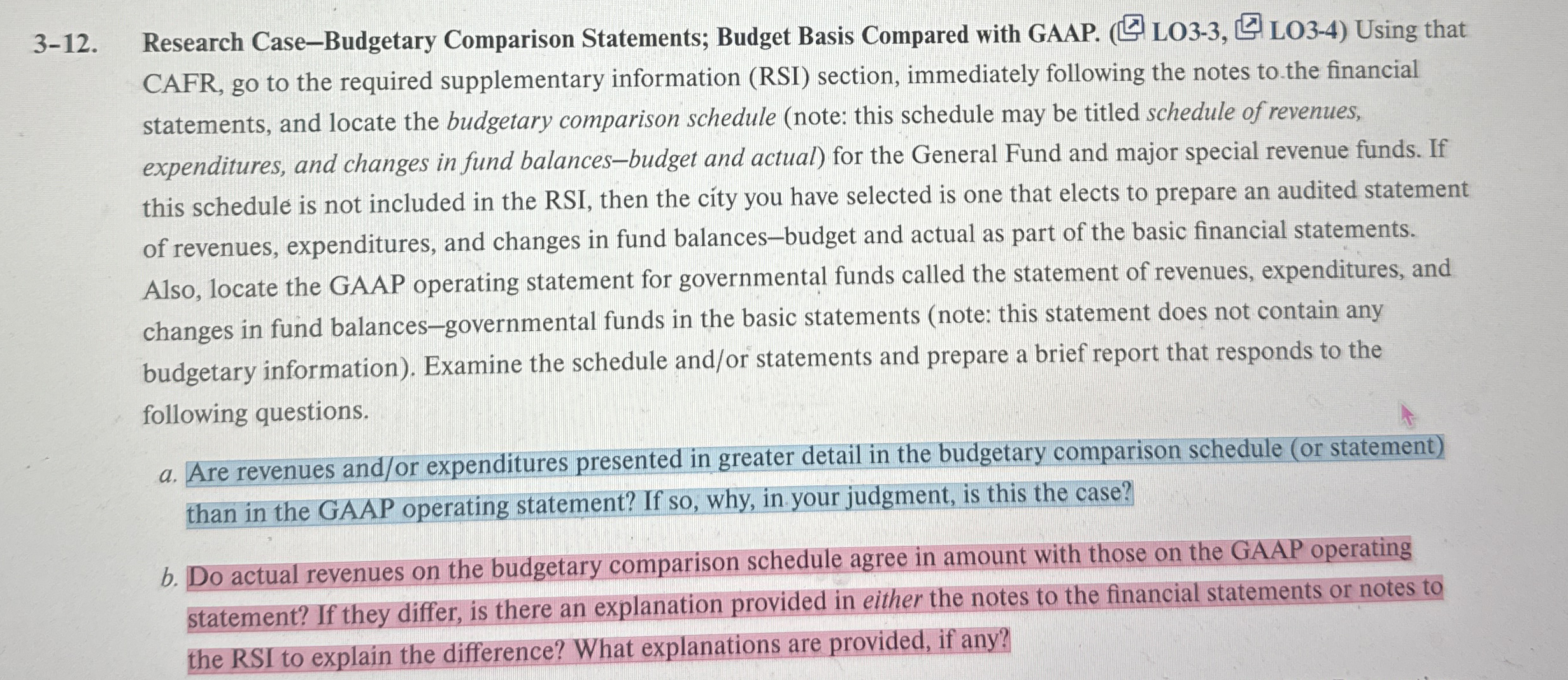

Research CaseBudgetary Comparison Statements; Budget Basis Compared with GAAP. LO LO Using that CAFR, go to the required supplementary information RSI section, immediately following the notes to the financial statements, and locate the budgetary comparison schedule note: this schedule may be titled schedule of revenues, expenditures, and changes in fund balancesbudget and actual for the General Fund and major special revenue funds. If this schedule is not included in the RSI, then the city you have selected is one that elects to prepare an audited statement of revenues, expenditures, and changes in fund balancesbudget and actual as part of the basic financial statements. Also, locate the GAAP operating statement for governmental funds called the statement of revenues, expenditures, and changes in fund balancesgovernmental funds in the basic statements note: this statement does not contain any budgetary information Examine the schedule andor statements and prepare a brief report that responds to the following questions.

a Are revenues andor expenditures presented in greater detail in the budgetary comparison schedule or statement than in the GAAP operating statement? If so why, in your judgment, is this the case?

b Do actual revenues on the budgetary comparison schedule agree in amount with those on the GAAP operating statement? If they differ, is there an explanation provided in either the notes to the financial statements or notes to the RSI to explain the difference? What explanations are provided, if any?

please do questions A and B

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock