Question: 3 - 1 3 B - LO 5 See Figure 3 . 8 on pages 3 - 2 3 to 3 - 2 5 Stan

B LO See Figure on pages to

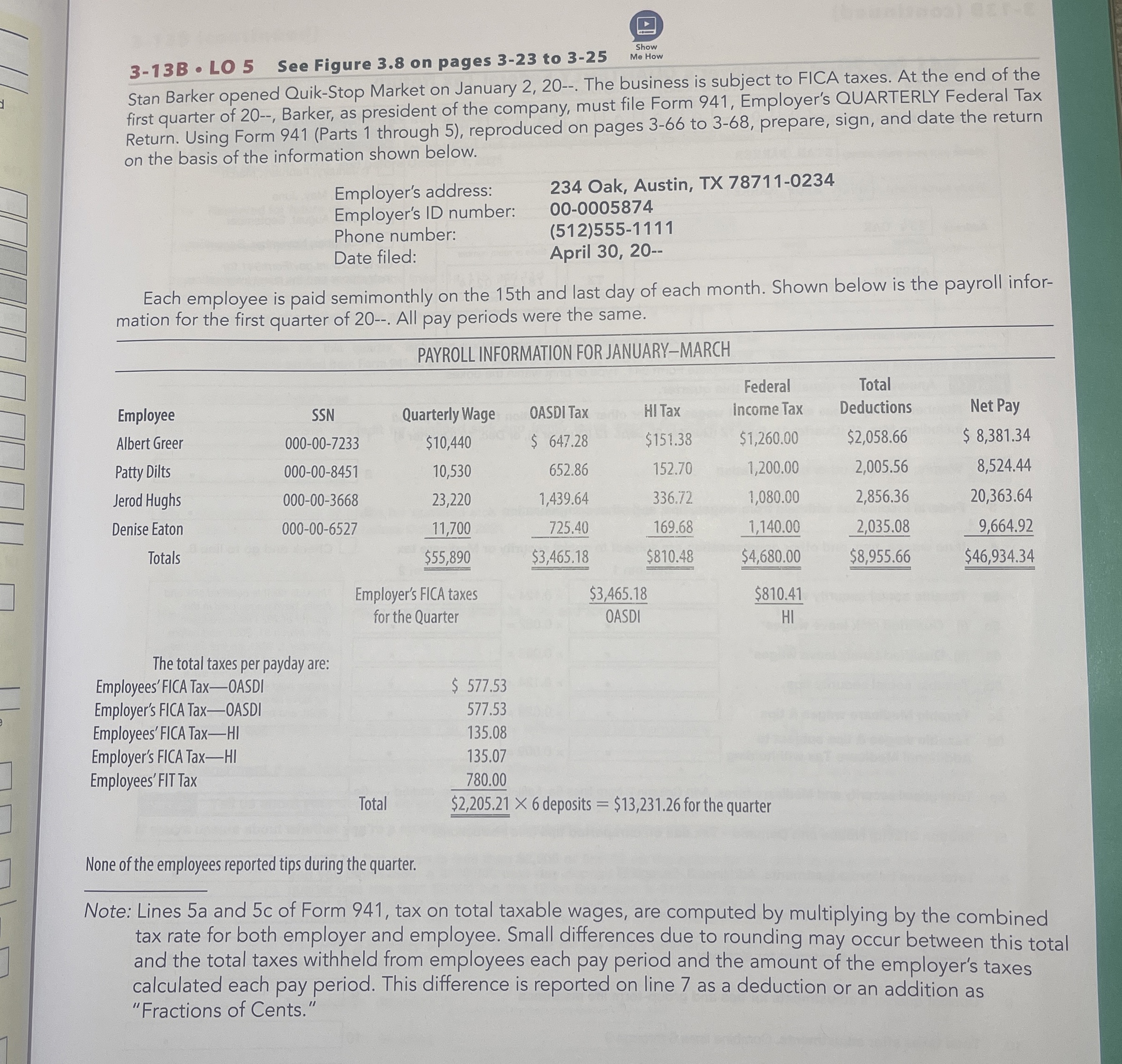

Stan Barker opened QuikStop Market on January The business is subject to FICA taxes. At the end of the

first quarter of Barker, as president of the company, must file Form Employer's QUARTERLY Federal Tax

Return. Using Form Parts through reproduced on pages to prepare, sign, and date the return

on the basis of the information shown below.

Each employee is paid semimonthly on the th and last day of each month. Shown below is the payroll infor

mation for the first quarter of All pay periods were the same.

PAYROLL INFORMATION FOR JANUARYMARCH

None of the employees reported tips during the quarter.

Note: Lines a and c of Form tax on total taxable wages, are computed by multiplying by the combined

tax rate for both employer and employee. Small differences due to rounding may occur between this total

and the total taxes withheld from employees each pay period and the amount of the employer's taxes

calculated each pay period. This difference is reported on line as a deduction or an addition as

"Fractions of Cents."

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock