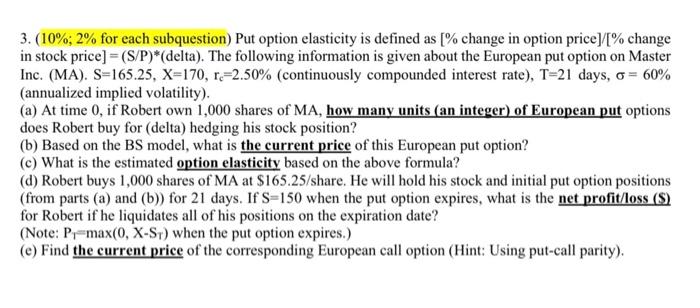

Question: 3. (10%, 2% for each subquestion) Put option elasticity is defined as [% change in option price][%change in stock price] =(S/P)*(delta). The following information is

3. (10%, 2% for each subquestion) Put option elasticity is defined as [% change in option price][%change in stock price] =(S/P)*(delta). The following information is given about the European put option on Master Inc. (MA). S=165.25, X=170, r=2.50% (continuously compounded interest rate), T=21 days, o= 60% (annualized implied volatility). (a) At time 0, if Robert own 1,000 shares of MA, how many units (an integer) of European put options does Robert buy for (delta) hedging his stock position? (b) Based on the BS model, what is the current price of this European put option? (c) What is the estimated option elasticity based on the above formula? (d) Robert buys 1,000 shares of MA at $165.25/share. He will hold his stock and initial put option positions (from parts (a) and (b)) for 21 days. If S=150 when the put option expires, what is the net profit/loss (S) for Robert if he liquidates all of his positions on the expiration date? (Note: P-max(0, X-Sr) when the put option expires.) (e) Find the current price of the corresponding European call option (Hint: Using put-call parity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts