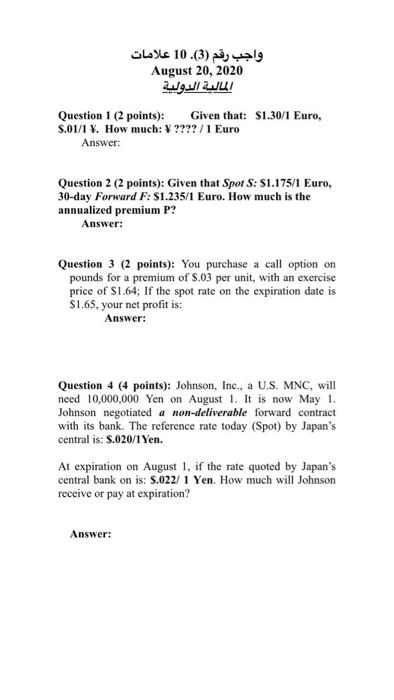

Question: (3). 10 (3) August 20, 2020 Question 1 (2 points): Given that: $1.30/1 Euro, 9.01/1 . How much: * ????/1 Euro Answer: Question 2 (2

(3). 10 (3) August 20, 2020 Question 1 (2 points): Given that: $1.30/1 Euro, 9.01/1 . How much: * ????/1 Euro Answer: Question 2 (2 points): Given that Spor S: $1.175/1 Euro, 30-day Forward F: $1.235/1 Euro. How much is the annualized premium P? Answer: Question 3 (2 points): You purchase a call option on pounds for a premium of $.03 per unit, with an exercise price of $1.64; If the spot rate on the expiration date is $1.65, your net profit is: Answer: Question 4 (4 points): Johnson, Inc., a U.S. MNC, will need 10,000,000 Yen on August 1. It is now May 1. Johnson negotiated a non-deliverable forward contract with its bank. The reference rate today (Spot) by Japan's central is: $.020/1 Yen. At expiration on August 1, if the rate quoted by Japan's central bank on is: 5.022/1 Yen. How much will Johnson receive or pay at expiration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts