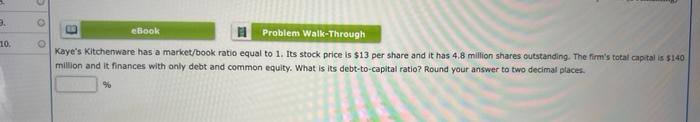

Question: 3 10. ebook Problem Walk-Through Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is $13 per share and it has 4.8

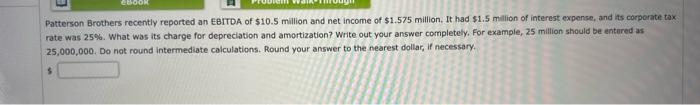

3 10. ebook Problem Walk-Through Kaye's Kitchenware has a market/book ratio equal to 1. Its stock price is $13 per share and it has 4.8 million shares outstanding. The firm's total capital is $140 million and it finances with only debt and common equity. What is its debt-to-capital ratio? Round your answer to two decimal places Patterson Brothers recently reported an EBITDA of $10.5 million and net income of $1.575 million. It had $1.5 million of interest expense, and its corporate tax rate was 25%. What was its charge for depreciation and amortization? Write out your answer completely. For example, 25 million should be entered as 25,000,000. Do not round Intermediate calculations. Round your answer to the nearest dollar, if necessary. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts