Question: 3. (10 points). Consider the portfolio choice problem. Let u(w) be the Bernoulli utility function of a decision maker (DM) with u' > 0 and

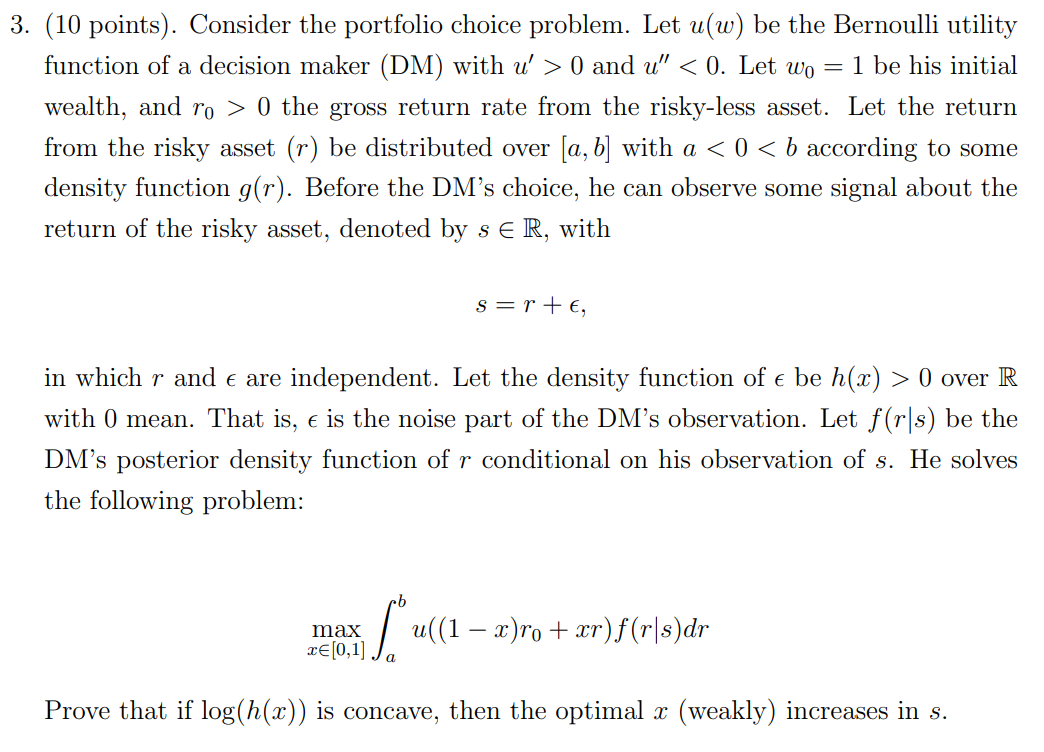

3. (10 points). Consider the portfolio choice problem. Let u(w) be the Bernoulli utility function of a decision maker (DM) with u' > 0 and u" 0 the gross return rate from the risky-less asset. Let the return from the risky asset (r) be distributed over [a, b] with a 0 over R with O mean. That is, e is the noise part of the DM's observation. Let f(r|s) be the DM's posterior density function of r conditional on his observation of s. He solves the following problem: max. ["u(1 2 )ro + xr)f(xls)der Prove that if log(h(x)) is concave, then the optimal x (weakly) increases in s. 3. (10 points). Consider the portfolio choice problem. Let u(w) be the Bernoulli utility function of a decision maker (DM) with u' > 0 and u" 0 the gross return rate from the risky-less asset. Let the return from the risky asset (r) be distributed over [a, b] with a 0 over R with O mean. That is, e is the noise part of the DM's observation. Let f(r|s) be the DM's posterior density function of r conditional on his observation of s. He solves the following problem: max. ["u(1 2 )ro + xr)f(xls)der Prove that if log(h(x)) is concave, then the optimal x (weakly) increases in s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts