Question: 3. [10 points) Please complete the Pro forma Income Statement and Balance Sheet on the next several pages based on the 2019 financial statements and

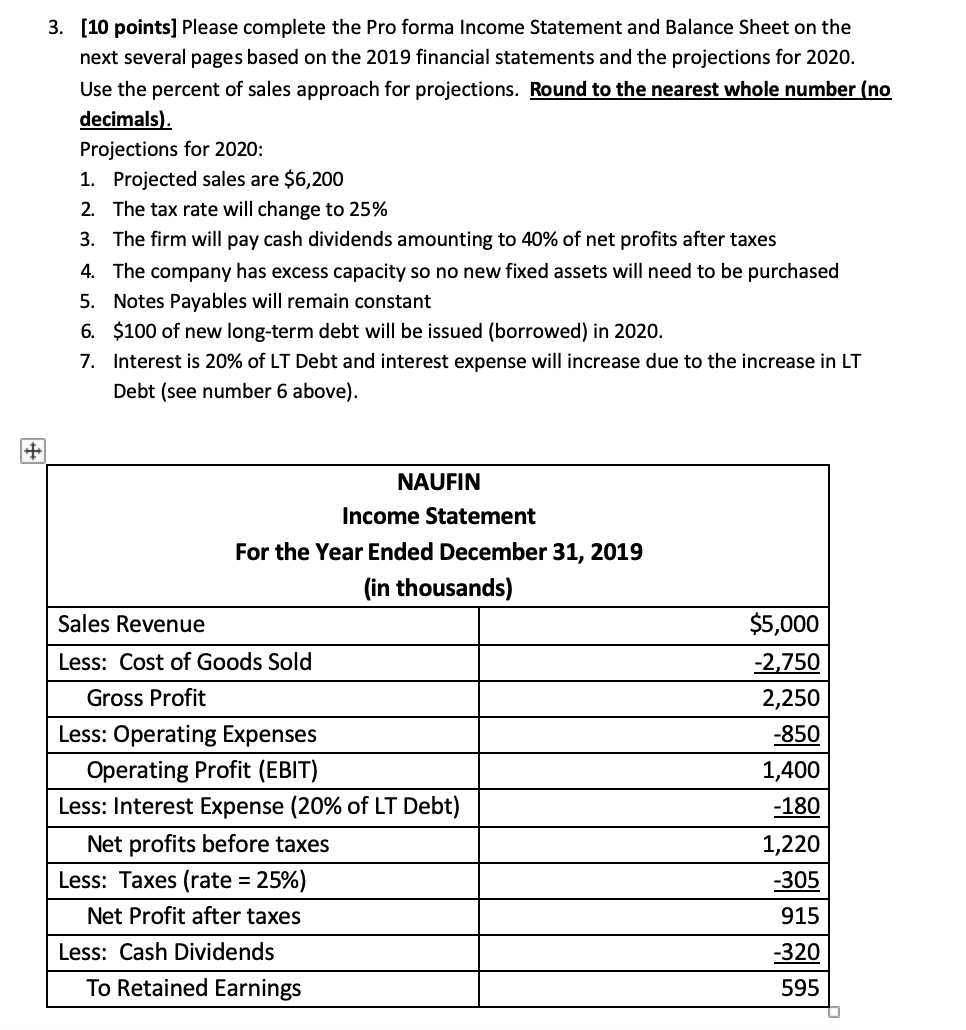

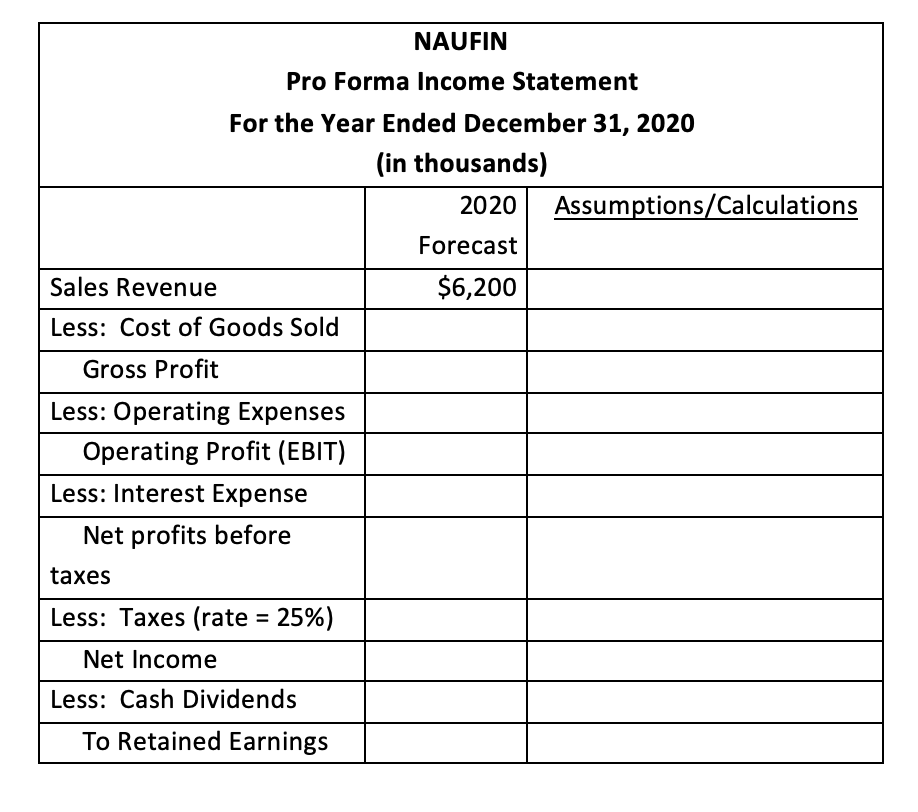

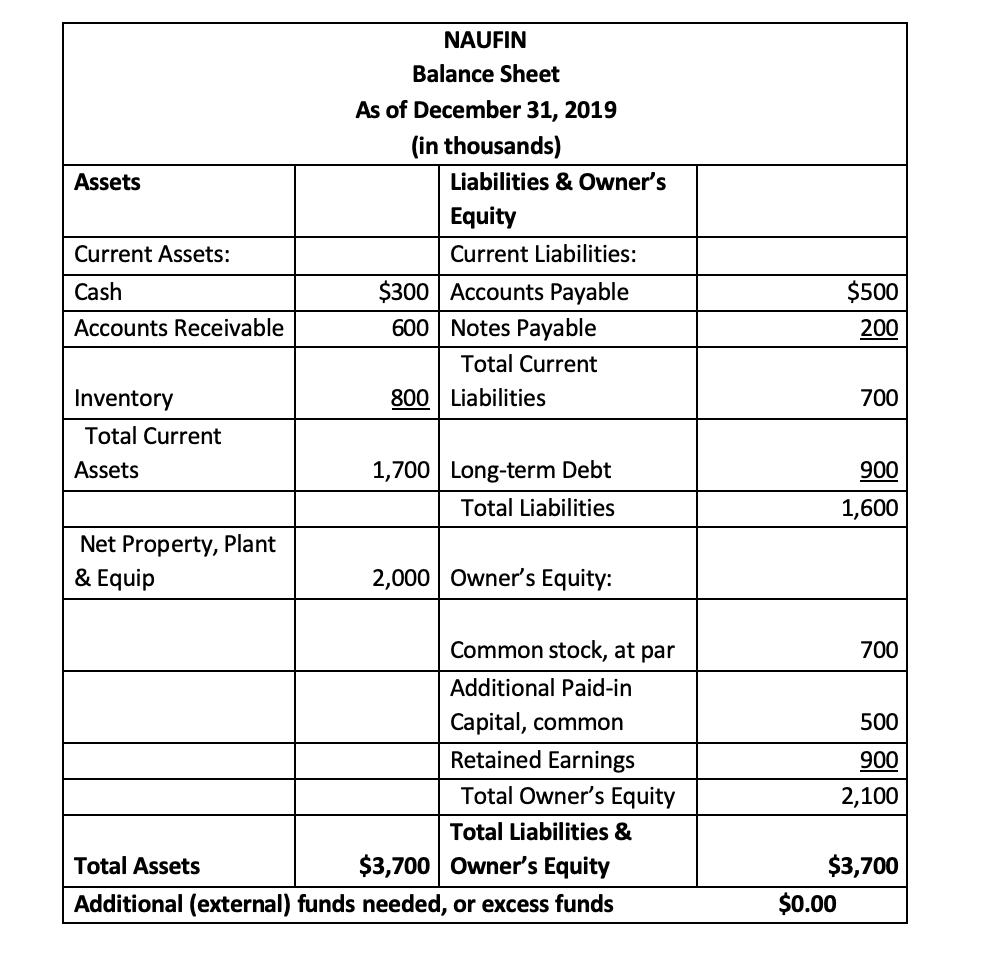

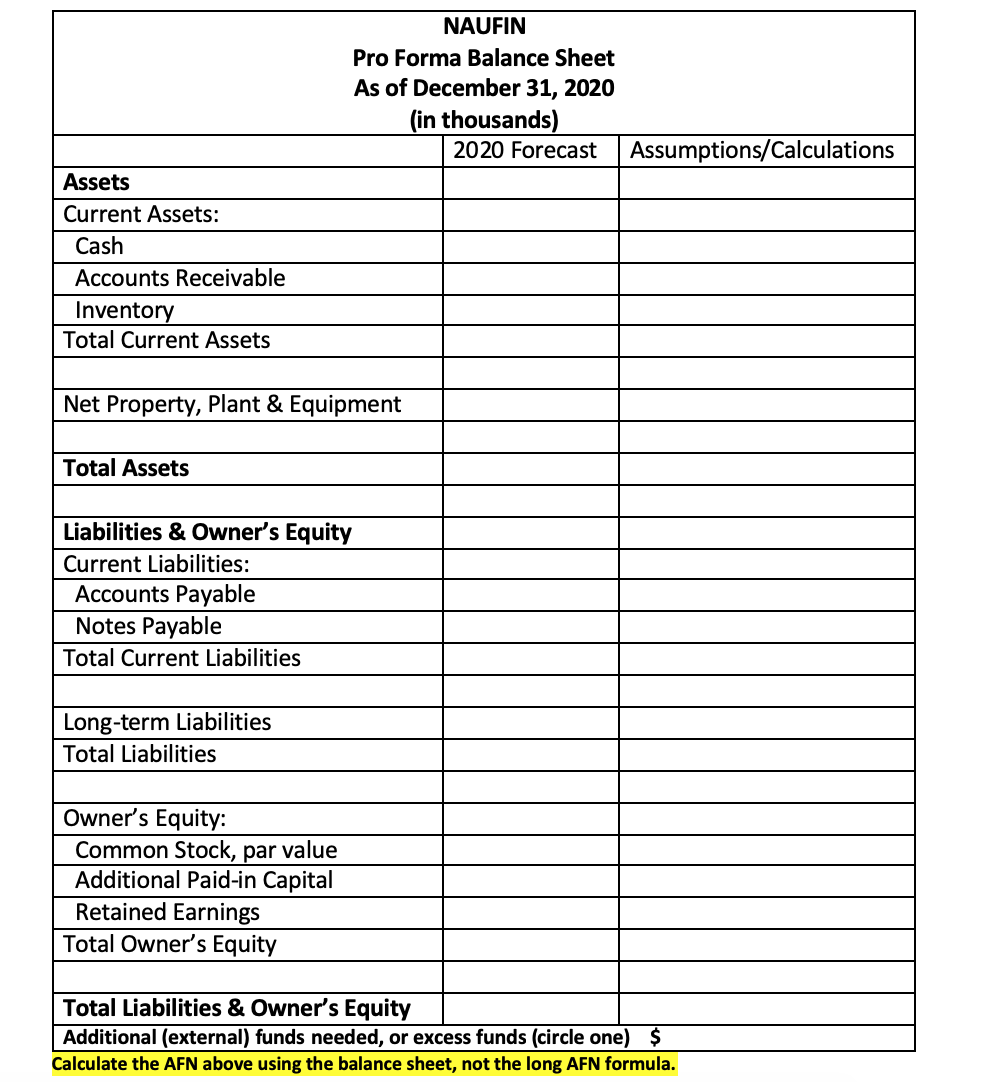

3. [10 points) Please complete the Pro forma Income Statement and Balance Sheet on the next several pages based on the 2019 financial statements and the projections for 2020. Use the percent of sales approach for projections. Round to the nearest whole number (no decimals). Projections for 2020: 1. Projected sales are $6,200 2. The tax rate will change to 25% 3. The firm will pay cash dividends amounting to 40% of net profits after taxes 4. The company has excess capacity so no new fixed assets will need to be purchased 5. Notes Payables will remain constant 6. $100 of new long-term debt will be issued (borrowed) in 2020. 7. Interest is 20% of LT Debt and interest expense will increase due to the increase in LT Debt (see number 6 above). NAUFIN Income Statement For the Year Ended December 31, 2019 (in thousands) Sales Revenue Less: Cost of Goods Sold Gross Profit Less: Operating Expenses Operating Profit (EBIT) Less: Interest Expense (20% of LT Debt) Net profits before taxes Less: Taxes (rate = 25%) Net Profit after taxes Less: Cash Dividends To Retained Earnings $5,000 -2,750 2,250 -850 1,400 -180 1,220 -305 915 -320 595 NAUFIN Pro Forma Income Statement For the Year Ended December 31, 2020 (in thousands) 2020 Assumptions/Calculations Forecast Sales Revenue $6,200 Less: Cost of Goods Sold Gross Profit Less: Operating Expenses Operating Profit (EBIT) Less: Interest Expense Net profits before taxes Less: Taxes (rate = 25%) Net Income Less: Cash Dividends To Retained Earnings Assets NAUFIN Balance Sheet As of December 31, 2019 (in thousands) Liabilities & Owner's Equity Current Liabilities: $300 Accounts Payable 600 Notes Payable Total Current 800 Liabilities Current Assets: Cash $500 200 Accounts Receivable 700 Inventory Total Current Assets 1,700 Long-term Debt Total Liabilities 900 1,600 Net Property, Plant & Equip 2,000 Owner's Equity: 700 500 Common stock, at par Additional Paid-in Capital, common Retained Earnings Total Owner's Equity Total Liabilities & Total Assets $3,700 Owner's Equity Additional (external) funds needed, or excess funds 900 2,100 $3,700 $0.00 NAUFIN Pro Forma Balance Sheet As of December 31, 2020 (in thousands) 2020 Forecast Assumptions/Calculations Assets Current Assets: Cash Accounts Receivable Inventory Total Current Assets Net Property, Plant & Equipment Total Assets Liabilities & Owner's Equity Current Liabilities: Accounts Payable Notes Payable Total Current Liabilities Long-term Liabilities Total Liabilities Owner's Equity: Common Stock, par value Additional Paid-in Capital Retained Earnings Total Owner's Equity Total Liabilities & Owner's Equity Additional (external) funds needed, or excess funds (circle one) $ Calculate the AFN above using the balance sheet, not the long AFN formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts