Question: 3. [10+10) (All important: An Application) Consider the following model to explain CEOs salaries in terms of annual firm sales, return on equity (roe, in

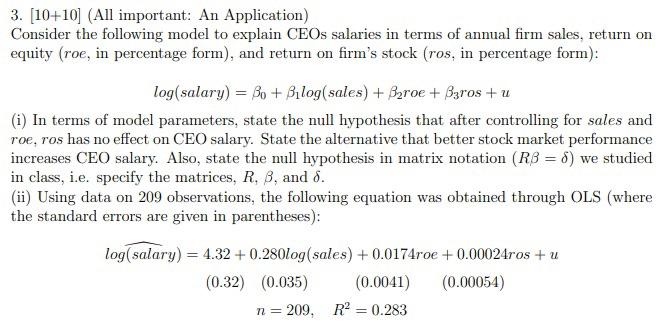

3. [10+10) (All important: An Application) Consider the following model to explain CEOs salaries in terms of annual firm sales, return on equity (roe, in percentage form), and return on firm's stock (ros, in percentage form): log(salary) = Bo + Bilog(sales) + Beroe + Bzros + u (i) In terms of model parameters, state the null hypothesis that after controlling for sales and roe, ros has no effect on CEO salary. State the alternative that better stock market performance increases CEO salary. Also, state the null hypothesis in matrix notation (RB = 8) we studied in class, i.e. specify the matrices, R, B, and 8. (ii) Using data on 209 observations, the following equation was obtained through OLS (where the standard errors are given in parentheses): log(salary) = 4.32 +0.280log(sales) +0.0174roe + 0.00024ros +u (0.32) (0.035) (0.0041) (0.00054) n=209, R2 = 0.283

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts