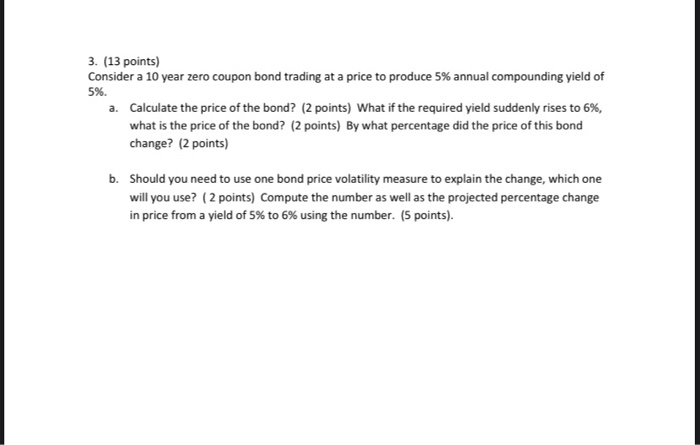

Question: 3. (13 points) Consider a 10 year zero coupon bond trading at a price to produce 5% annual compounding yield of 5%. a. Calculate the

3. (13 points) Consider a 10 year zero coupon bond trading at a price to produce 5% annual compounding yield of 5%. a. Calculate the price of the bond? (2 points) What if the required yield suddenly rises to 6%, what is the price of the bond? (2 points) By what percentage did the price of this bond change? (2 points) b. Should you need to use one bond price volatility measure to explain the change, which one will you use? (2 points) Compute the number as well as the projected percentage change in price from a yield of 5% to 6% using the number. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts