Question: 3 . ( 2 0 points ) . Baron Corporation provided the following performance report for the last year. In a meeting with the board

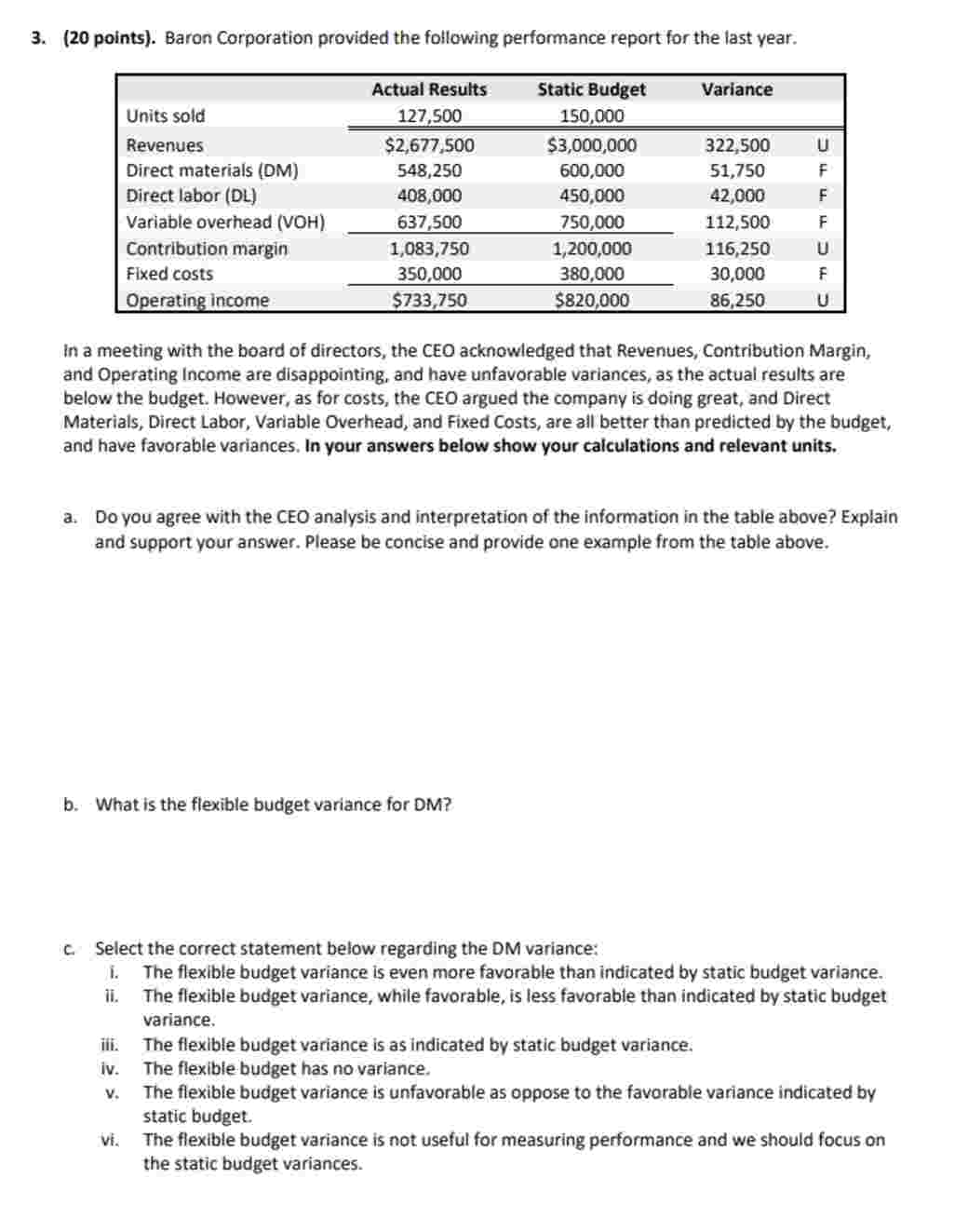

points Baron Corporation provided the following performance report for the last year.

In a meeting with the board of directors, the CEO acknowledged that Revenues, Contribution Margin, and Operating Income are disappointing, and have unfavorable variances, as the actual results are below the budget. However, as for costs, the CEO argued the company is doing great, and Direct Materials, Direct Labor, Variable Overhead, and Fixed Costs, are all better than predicted by the budget, and have favorable variances. In your answers below show your calculations and relevant units.

a Do you agree with the CEO analysis and interpretation of the information in the table above? Explain and support your answer. Please be concise and provide one example from the table above.

b What is the flexible budget variance for DM

c Select the correct statement below regarding the DM variance:

i The flexible budget variance is even more favorable than indicated by static budget variance.

ii The flexible budget variance, while favorable, is less favorable than indicated by static budget variance.

iii. The flexible budget variance is as indicated by static budget variance.

iv The flexible budget has no variance.

v The flexible budget variance is unfavorable as oppose to the favorable variance indicated by static budget.

vi The flexible budget variance is not useful for measuring performance and we should focus on the static budget variances. d What is the flexible budget variance for DL

e Select the correct statement below regarding the DL variance:

i The flexible budget variance is even more favorable than indicated by static budget variance.

ii The flexible budget variance, while favorable, is less favorable than indicated by static budget variance.

iii. The flexible budget variance is as indicated by static budget variance.

iv The flexible budget has no variance.

v The flexible budget variance is unfavorable as oppose to the favorable variance indicated by static budget.

vi The flexible budget variance is not useful for measuring performance and we should focus on the static budget variances.

f What is the flexible budget variance for VOH

g Select the correct statement below regarding the VOH variance:

i The flexible budget variance is even more favorable than indicated by static budget variance.

ii The flexible budget variance, while favorable, is less favorable than indicated by static budget variance.

iii. The flexible budget variance is as indicated by static budget variance.

iv The flexible budget has no variance.

v The flexible budget variance is unfavorable as oppose to the favorable variance indicated by static budget.

vi The flexible budget variance is not useful for measuring performance and we should focus on the static budget variances.

h Mr Bencat, the chair of the board of directors' compensation committee, argues that the CEO has disappointed big time and should not receive a bonus this year and perhaps even be replaced. Do you tend to agree or disagree with Mr Bencat? What counter argument can be made?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock