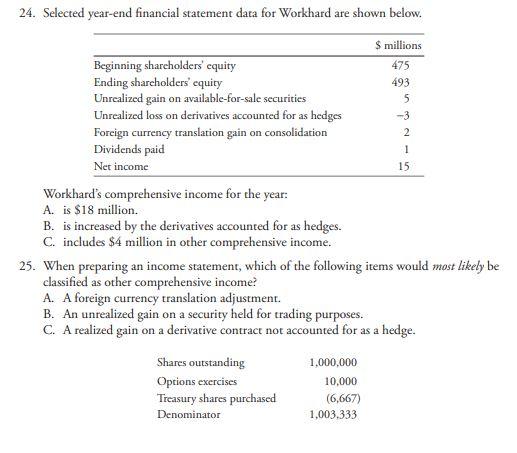

Question: -3 2 1 15 24. Selected year-end financial statement data for Workhard are shown below. $ millions Beginning shareholders equity 475 Ending shareholders' equity 493

-3 2 1 15 24. Selected year-end financial statement data for Workhard are shown below. $ millions Beginning shareholders equity 475 Ending shareholders' equity 493 Unrealized gain on available-for-sale securities 5 Unrealized loss on derivatives accounted for as hedges Foreign currency translation gain on consolidation Dividends paid Net income Workhard's comprehensive income for the year: A. is $18 million. B. is increased by the derivatives accounted for as hedges. C. includes $4 million in other comprehensive income. 25. When preparing an income statement, which of the following items would most likely be classified as other comprehensive income? A. A foreign currency translation adjustment. B. An unrealized gain on a security held for trading purposes. C. A realized gain on a derivative contract not accounted for as a hedge. Shares outstanding 1,000,000 Options exercises 10,000 Treasury shares purchased (6,667) Denominator 1,003.333

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts