Question: 3 : 2 2 7 LTE 6 4 Google Lens Select text 1 2 . You are considering starting a bookstore. You own a real

:

LTE

Google Lens

Select text

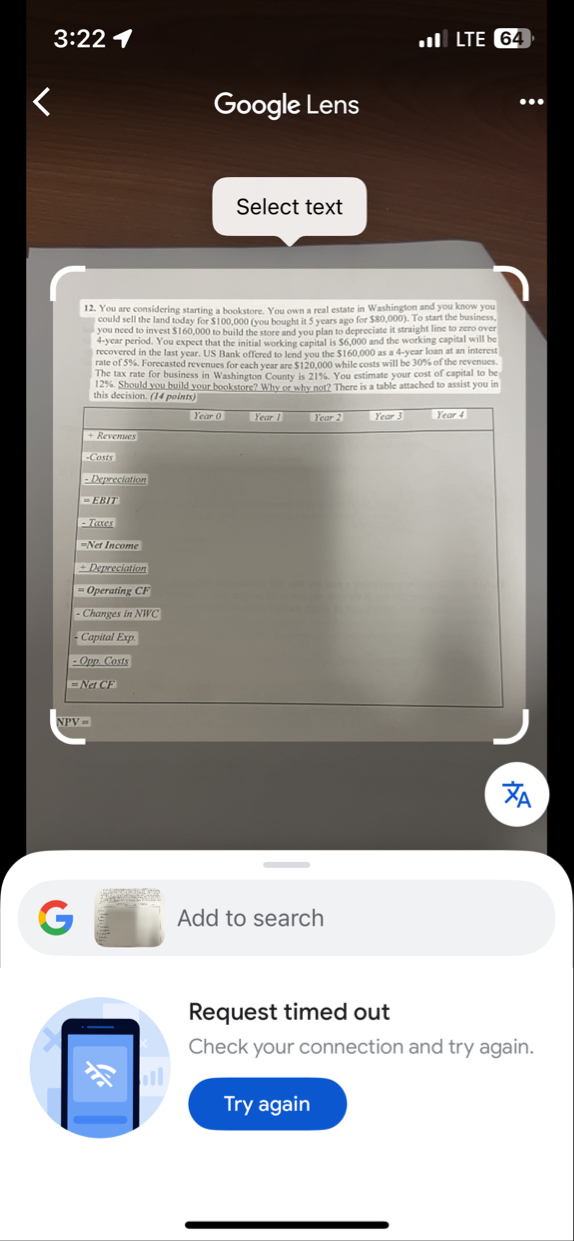

You are considering starting a bookstore. You own a real estate in Washington and you know you could sell the land today for $you bought it years ago for $$ To start the business, you need to invest $ to build the store and you plan to depreciate it straight line to zero over year period. You expect that the initial working capital is $ and the working capital will be recovered in the last year. US Bank offered to lend you the $ as a year loan at an interest rate of Forecasted revenues for each year are $ while costs will be of the revenues. The tax rate for business In Washington County is You estimate your cost of capital to be Should you build your bookstore? Why or why not? There is a table attached to assist you in this decision. points

NPV

G

Add to search

Request timed out

Check your connection and try again.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock