Question: 3 2 9 Required information Problem 1 1 - 5 0 ( LO 1 1 - 5 ) ( Algo ) [ The following information

Required information

Problem LO Algo

The following information applies to the questions displayed below.

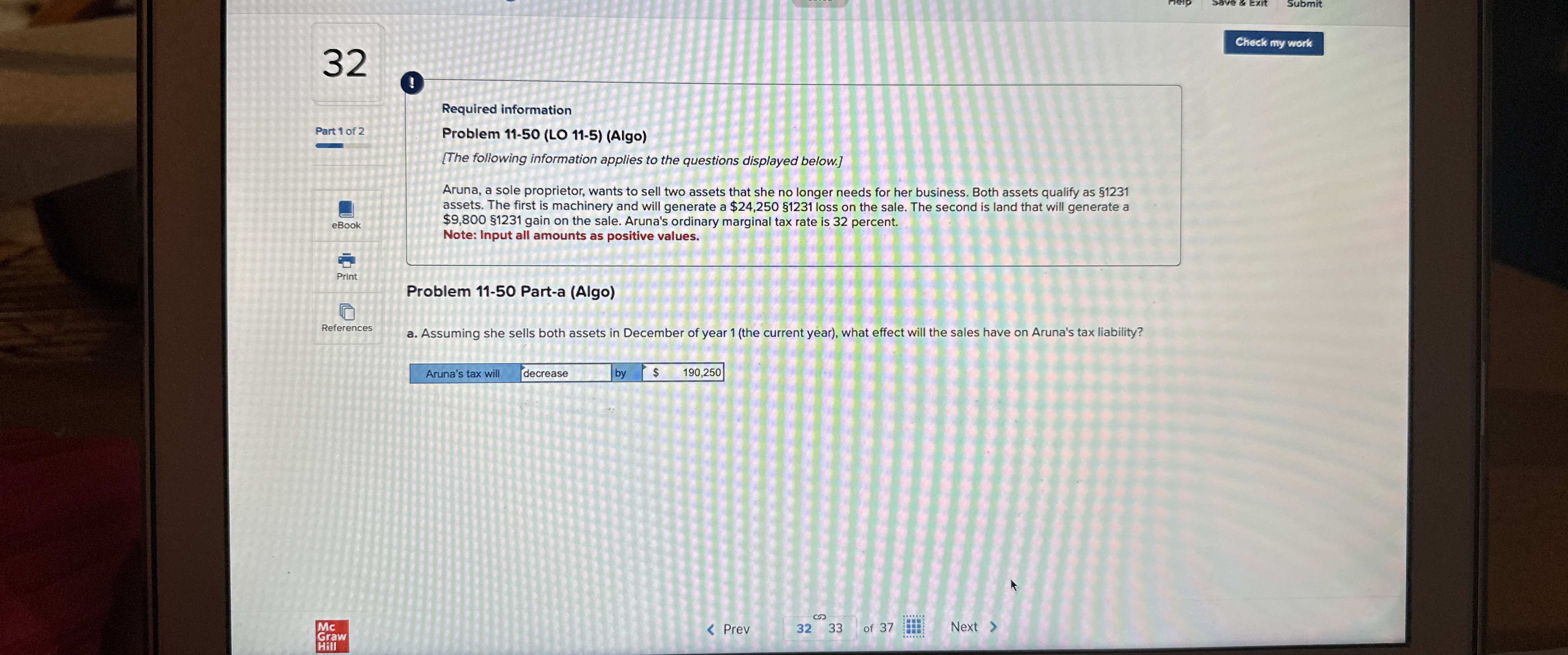

Aruna, a sole proprietor, wants to sell two assets that she no longer needs for her business. Both assets qualify as $ assets. The first is machinery and will generate a $$ loss on the sale. The second is land that will generate a $$ gain on the sale. Aruna's ordinary marginal tax rate is percent. Note: Input all amounts as positive values.

Problem Parta Algo

References

a Assuming she sells both assets in December of year the current year what effect will the sales have on Aruna's tax liability?

tableArunas tax will,decrease,by$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock