Question: 3. (20 marks) Our company must replace an existing machine. Assuming MARR as 10% and the following data for current and the new machine, analyze

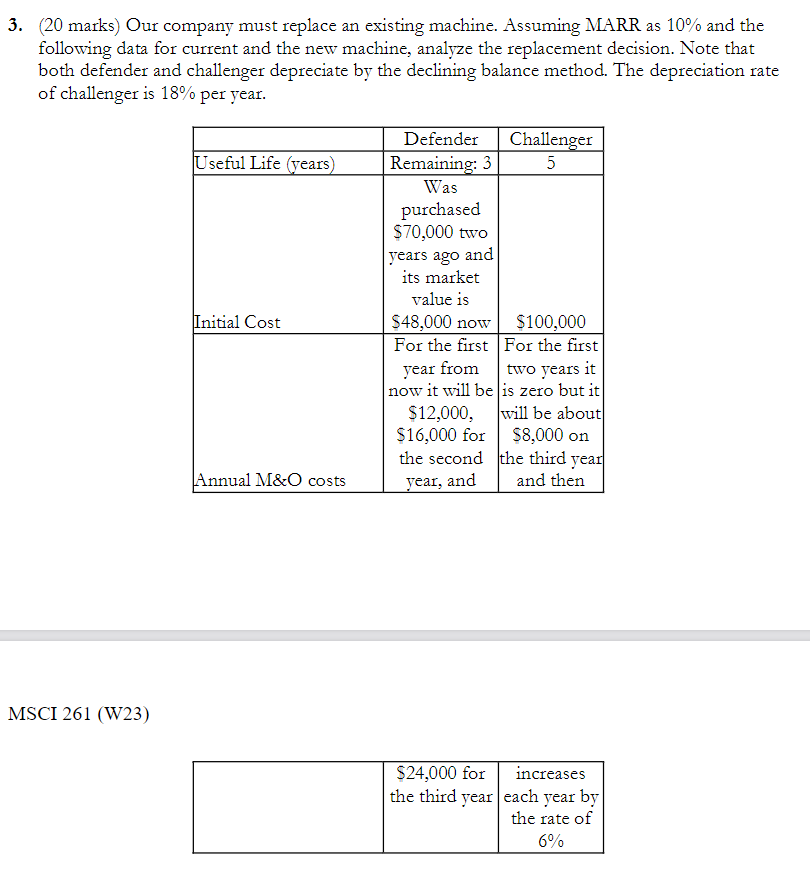

3. (20 marks) Our company must replace an existing machine. Assuming MARR as 10% and the following data for current and the new machine, analyze the replacement decision. Note that both defender and challenger depreciate by the declining balance method. The depreciation rate of challenger is 18% per year. Defender Challenger Useful Life (years Remaining: 3 5 Was purchased $70,000 two years ago and its market value is Initial Cost $48,000 now $100,000 For the first For the first year from two years it now it will be is zero but it $12,000, will be about $16,000 for $8,000 on the second the third year Annual M&O costs year, and and then MSCI 261 (W23) $24,000 for increases the third year each year by the rate of 6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts