Question: 3. (20 points) Correlation of Bond Yields Consider the example we discussed in the lecture. Suppose that the Bank of Canada conducted an open market

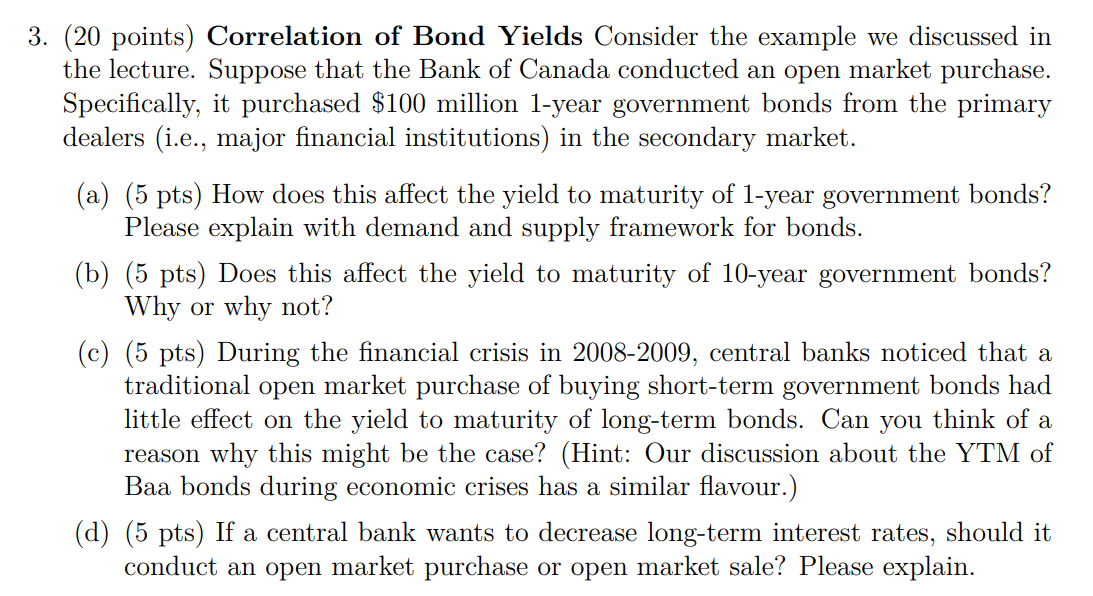

3. (20 points) Correlation of Bond Yields Consider the example we discussed in the lecture. Suppose that the Bank of Canada conducted an open market purchase. Specifically, it purchased $100 million 1-year government bonds from the primary dealers (i.e., major financial institutions) in the secondary market. (a) (5 pts) How does this affect the yield to maturity of 1-year government bonds? Please explain with demand and supply framework for bonds. (b) (5 pts) Does this affect the yield to maturity of 10-year government bonds? Why or why not? (c) (5 pts) During the financial crisis in 2008-2009, central banks noticed that a traditional open market purchase of buying short-term government bonds had little effect on the yield to maturity of long-term bonds. Can you think of a reason why this might be the case? (Hint: Our discussion about the YTM of Baa bonds during economic crises has a similar flavour.) (d) (5 pts) If a central bank wants to decrease long-term interest rates, should it conduct an open market purchase or open market sale? Please explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts