Question: 3. (20 points). This question uses a numerical example to understand the connections between the goods, money, and foreign exchange (FX) markets. Additionally, it explores

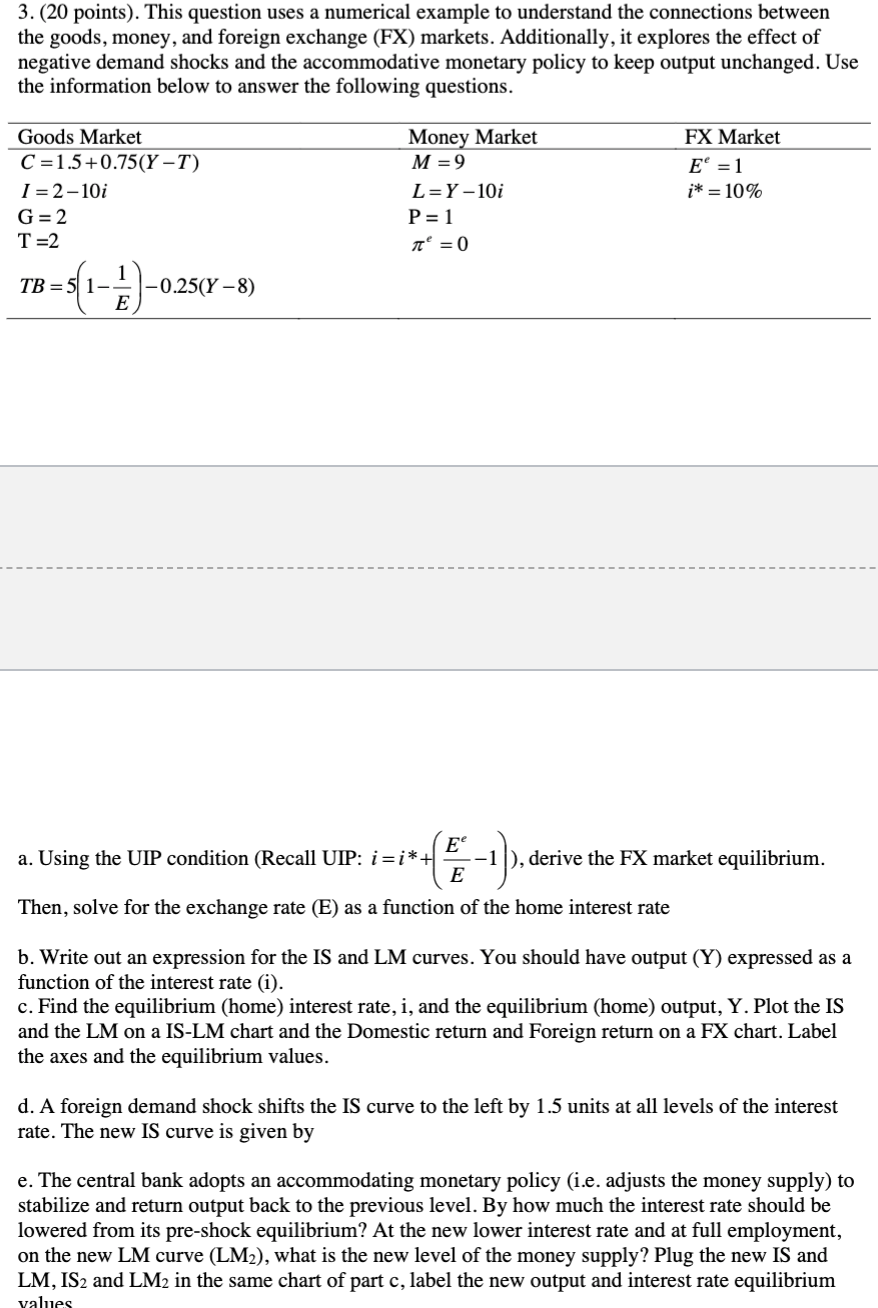

3. (20 points). This question uses a numerical example to understand the connections between the goods, money, and foreign exchange (FX) markets. Additionally, it explores the effect of negative demand shocks and the accommodative monetary policy to keep output unchanged. Use the information below to answer the following questions. a. Using the UIP condition (Recall UIP: i=i+(EEe1) ), derive the FX market equilibrium. Then, solve for the exchange rate (E) as a function of the home interest rate b. Write out an expression for the IS and LM curves. You should have output (Y) expressed as a function of the interest rate (i). c. Find the equilibrium (home) interest rate, i, and the equilibrium (home) output, Y. Plot the IS and the LM on a IS-LM chart and the Domestic return and Foreign return on a FX chart. Label the axes and the equilibrium values. d. A foreign demand shock shifts the IS curve to the left by 1.5 units at all levels of the interest rate. The new IS curve is given by e. The central bank adopts an accommodating monetary policy (i.e. adjusts the money supply) to stabilize and return output back to the previous level. By how much the interest rate should be lowered from its pre-shock equilibrium? At the new lower interest rate and at full employment, on the new LM curve (LM2), what is the new level of the money supply? Plug the new IS and LM,IS2 and LM2 in the same chart of part c, label the new output and interest rate equilibrium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts