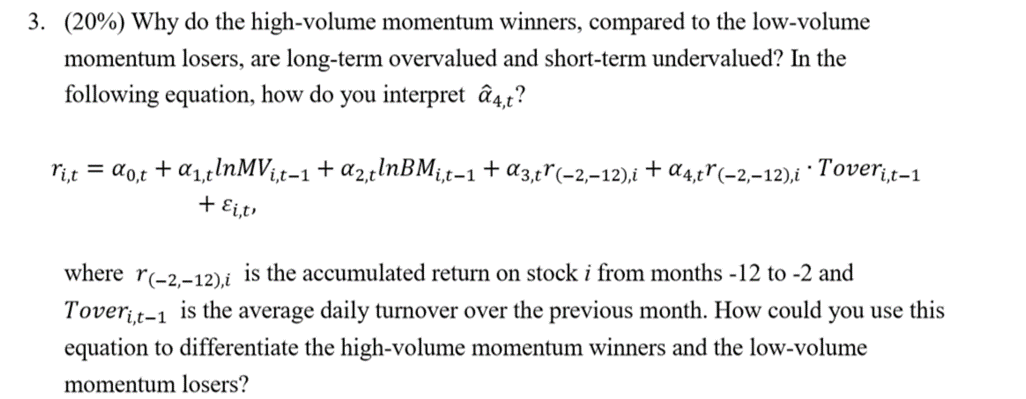

Question: 3. (20%) Why do the high-volume momentum winners, compared to the low-volume momentum losers, are long-term overvalued and short-term undervalued? In the following equation, how

3. (20%) Why do the high-volume momentum winners, compared to the low-volume momentum losers, are long-term overvalued and short-term undervalued? In the following equation, how do you interpret @4,t? rint = 20,t +21,2lnMVi,t-1 + a2,4lnBMi,t-1 +23,87(-2,-12),i + $4,tr(-2,-12),i Toveri,t-1 + Ei,t) where r(-2,-12),i is the accumulated return on stock i from months - 12 to -2 and Toveri,t-1 is the average daily turnover over the previous month. How could you use this equation to differentiate the high-volume momentum winners and the low-volume momentum losers? 3. (20%) Why do the high-volume momentum winners, compared to the low-volume momentum losers, are long-term overvalued and short-term undervalued? In the following equation, how do you interpret @4,t? rint = 20,t +21,2lnMVi,t-1 + a2,4lnBMi,t-1 +23,87(-2,-12),i + $4,tr(-2,-12),i Toveri,t-1 + Ei,t) where r(-2,-12),i is the accumulated return on stock i from months - 12 to -2 and Toveri,t-1 is the average daily turnover over the previous month. How could you use this equation to differentiate the high-volume momentum winners and the low-volume momentum losers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts