Question: 3. (22 points) Consider two firms, U and L, both with $50,000 in assets. Firm U is unlevered, and firm L has $20,000 of debt

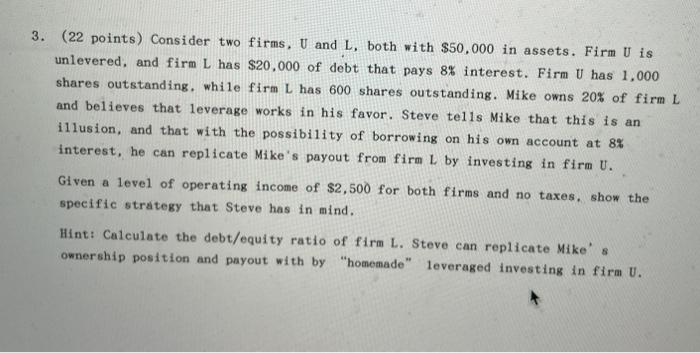

3. (22 points) Consider two firms, U and L, both with $50,000 in assets. Firm U is unlevered, and firm L has $20,000 of debt that pays 8% interest. Firm U has 1,000 shares outstanding, while firm L has 600 shares outstanding. Mike owns 20% of firm L and believes that leverage works in his favor. Steve tells Mike that this is an illusion, and that with the possibility of borrowing on his own account at 8% interest, he can replicate Mike's payout from firm L by investing in firm U. Given a level of operating income of $2,500 for both firms and no taxes, show the specific strategy that Steve has in mind. Hint: Calculate the debt/equity ratio of firm L. Steve can replicate Mike's ownership position and payout with by "homemade" leveraged investing in firm U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts