Question: 3. (25 points) Your company is considering a five-year project to boost its sales. By purchasing a new machine, you expect to increase sales by

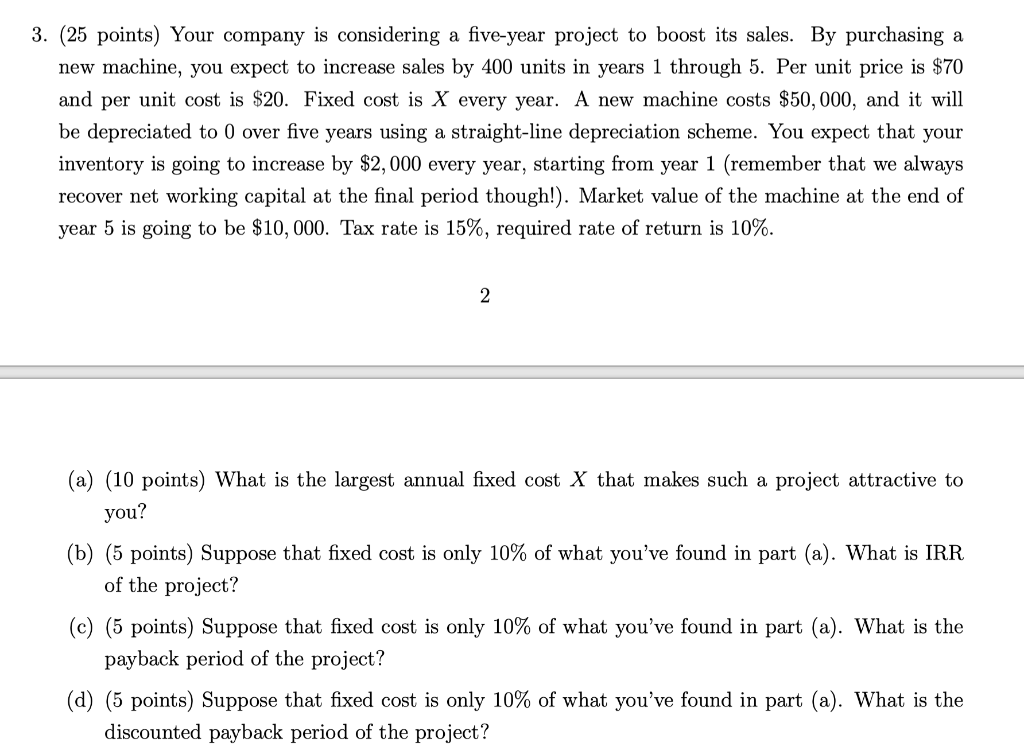

3. (25 points) Your company is considering a five-year project to boost its sales. By purchasing a new machine, you expect to increase sales by 400 units in years 1 through 5 . Per unit price is $70 and per unit cost is $20. Fixed cost is X every year. A new machine costs $50,000, and it will be depreciated to 0 over five years using a straight-line depreciation scheme. You expect that your inventory is going to increase by $2,000 every year, starting from year 1 (remember that we always recover net working capital at the final period though!). Market value of the machine at the end of year 5 is going to be $10,000. Tax rate is 15%, required rate of return is 10%. 2 (a) (10 points) What is the largest annual fixed cost X that makes such a project attractive to you? (b) (5 points) Suppose that fixed cost is only 10% of what you've found in part (a). What is IRR of the project? (c) (5 points) Suppose that fixed cost is only 10% of what you've found in part (a). What is the payback period of the project? (d) (5 points) Suppose that fixed cost is only 10% of what you've found in part (a). What is the discounted payback period of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts