Question: 3. [29 marks) Brownian motion is a widely-used random process. It has been used in engineering, nance, and physical sciences. It is a Gaussian random

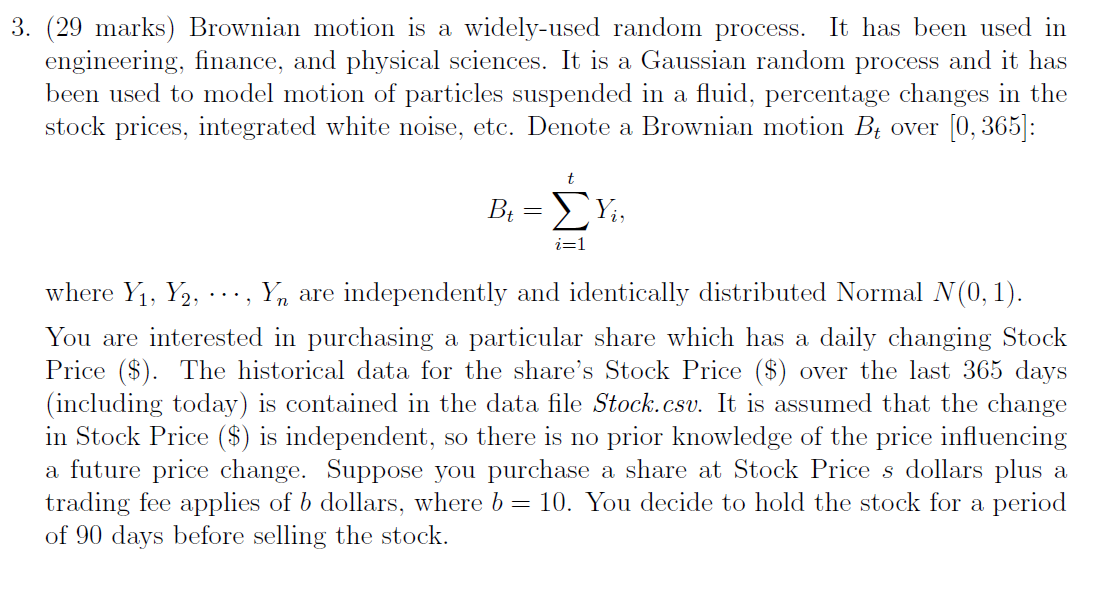

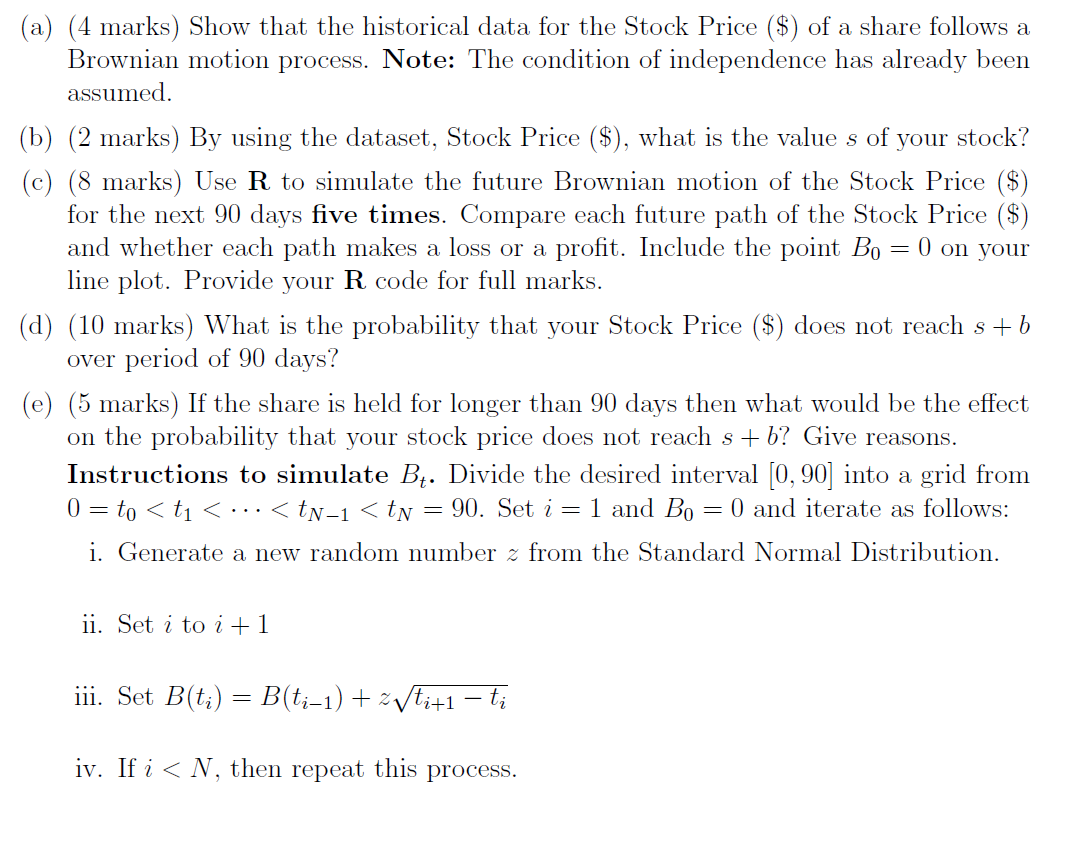

3. [29 marks) Brownian motion is a widely-used random process. It has been used in engineering, nance, and physical sciences. It is a Gaussian random process and it has been used to model motion of particles suspended in a uid, percentage changes in the stock prices, integrated white noise, etc. Denote a Brownian motion B, over [0, 365]: t B: :ZYz'a i=1 where Y1, Y2, - - - , Yn are independently and identically distributed Normal N (U, 1). You are interested in purchasing a particular share which has a daily changing Stock Price [$). The historical data for the share's Stock Price ($) over the last 365 days [including today) is contained in the data le Stockcsv. It is assumed that the change in Stock Price (33) is independent, so there is no prior knowledge of the price inuencing a future price change. Suppose you purchase a share at Stock Price 3 dollars plus a trading fee applies of .5 dollars, where b : 10. You decide to hold the stock for a period of 90 days before selling the stock. (a) (4 marks) Show that the historical data for the Stock Price ($) of a share follows a Brownian motion process. Note: The condition of independence has already been assumed. (b) (2 marks) By using the dataset, Stock Price [$), what is the value 3 of your stock"? (c) (8 marks) Use R to simulate the future Brownian motion of the Stock Price ($) for the next 90 days ve times. Compare each future path of the Stock Price ($) and whether each path makes a loss or a prot. Include the point Bo : 0 on your line plot. Provide your R code for full marks. ((1) (10 marks) What is the probability that your Stock Price ($) does not reach 8 | I) over period of 90 days? (e) (5 marks) If the share is held for longer than 90 days then what would be the effect on the probability that your stock price does not reach .9 | I)? Give reasons. Instructions to simulate Bi. Divide the desired interval [0, 90] into a grid from U : to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts