Question: % % 3% 3% 0% 1% 7% 3% 6% 1% 12% 92% 02% 15% Calculate the expected return and standard deviation for each asset

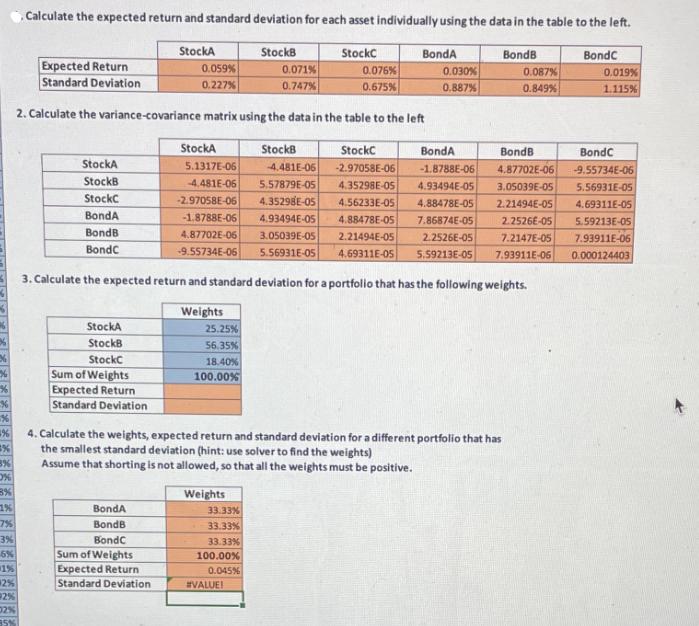

% % 3% 3% 0% 1% 7% 3% 6% 1% 12% 92% 02% 15% Calculate the expected return and standard deviation for each asset individually using the data in the table to the left. StockB StockC Expected Return Standard Deviation 0.059% 0.227% 2. Calculate the variance-covariance matrix using the data in the table to the left StockA StockB StockC BondA BondB BondC StockA StockB StockC Sum of Weights Expected Return Standard Deviation StockA BondA BondB BondC Sum of Weights Expected Return Standard Deviation StockA StockC BondA -1.8788E-06 5.1317E-06 -4.481E-06 -2.97058E-06 -4.481E-06 5.57879E-05 4.35298E-05 4.93494E-05 -2.97058E-06 4.35298E-05 4.56233E-05 4.88478E-05 4.88478E-05 7.86874E-05 -1.8788E-06 4.93494E-05 4.87702E-06 3.05039E-05 2.21494E-05 2.2526E-05 5.56931E-05 4.69311E-05 5.59213E-05 -9.55734E-06 3. Calculate the expected return and standard deviation for a portfolio that has the following weights. Weights 25.25% 56.35% 18.40% 100.00% Weights 0.071% 0.747% 33.33% 33.33% 33.33% 100.00% 0.045% #VALUE! Bonda 0.076% 0.675% StockB 4. Calculate the weights, expected return and standard deviation for a different portfolio that has the smallest standard deviation (hint: use solver to find the weights) Assume that shorting is not allowed, so that all the weights must be positive. 0.030% 0.887% BondB 0.087% 0.849% BondB 4.87702E-06 3.05039E-05 2.21494E-05 2.2526E-05 7.2147E-05 7.93911E-06 BondC 0.019% 1.115% BondC -9.55734E-06 5.56931E-05 4.69311E-05 5.59213E-05 7.93911E-06 0.000124403

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the expected return and standard deviation for each asset individually StockA Expected ... View full answer

Get step-by-step solutions from verified subject matter experts