Question: 3 3 64 Question 3 (9 points) Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company usually produces all

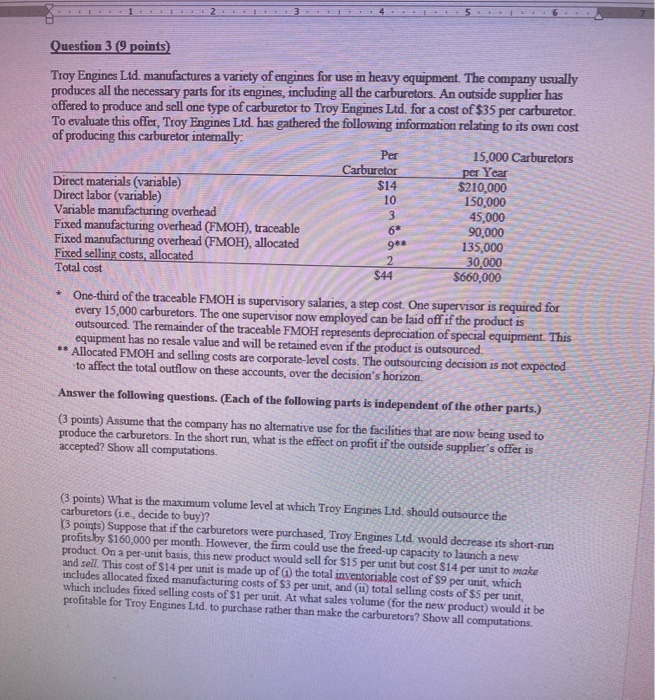

3 3 64 Question 3 (9 points) Troy Engines Ltd. manufactures a variety of engines for use in heavy equipment. The company usually produces all the necessary parts for its engines, including all the carburetors. An outside supplier has offered to produce and sell one type of carburetor to Troy Engines Ltd. for a cost of $35 per carburetor. To evaluate this offer, Troy Engines Ltd. has gathered the following information relating to its own cost of producing this carburetor internally: Per 15,000 Carburetors Carburetor per Year Direct materials (variable) $14 $210,000 Direct labor (variable) 10 150,000 Variable manufacturing overhead 45,000 Fixed manufacturing overhead (FMOH), traceable 90,000 Fixed manufacturing overhead (FMOH), allocated 135,000 Fixed selling costs, allocated 2 30,000 Total cost $44 $660,000 * One-third of the traceable FMOH is supervisory salaries, a step cost. One supervisor is required for every 15,000 carburetors. The one supervisor now employed can be laid off if the product is outsourced. The remainder of the traceable FMOH represents depreciation of special equipment. This equipment has no resale value and will be retained even if the product is outsourced. ** Allocated FMOH and selling costs are corporate-level costs. The outsourcing decision is not expected to affect the total outflow on these accounts, over the decision's horizon Answer the following questions. (Each of the following parts is independent of the other parts.) (3 points) Assume that the company has no alternative use for the facilities that are now being used to produce the carburetors. In the short run, what is the effect on profit if the outside supplier's offer is accepted? Show all computations. 9* (3 points) What is the maximum volume level at which Troy Engines Ltd should outsource the carburetors (ie, decide to buy)? (3 points) Suppose that if the carburetors were purchased, Troy Engines Ltd would decrease its short-run profits by $160.000 per month. However, the firm could use the freed-up capacity to launch a new product. On a per-unit basis, this new product would sell for $15 per unit but cost $14 per unit to make and sell. This cost of $14 per unit is made up of the total inventoriable cost of $9 per unit, which includes allocated fixed manufacturing costs of $3 per unit, and (ii) total selling costs of $5 per unit, which includes fixed selling costs of $i per unit. At what sales volume (for the new product) would it be profitable for Troy Engines Ltd. to purchase rather than make the carburetors? Show all computations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts