Question: 3 / 3 82% + 4. A small business owner currently has $50,000 of retained earnings to invest for 5 years. The owner has an

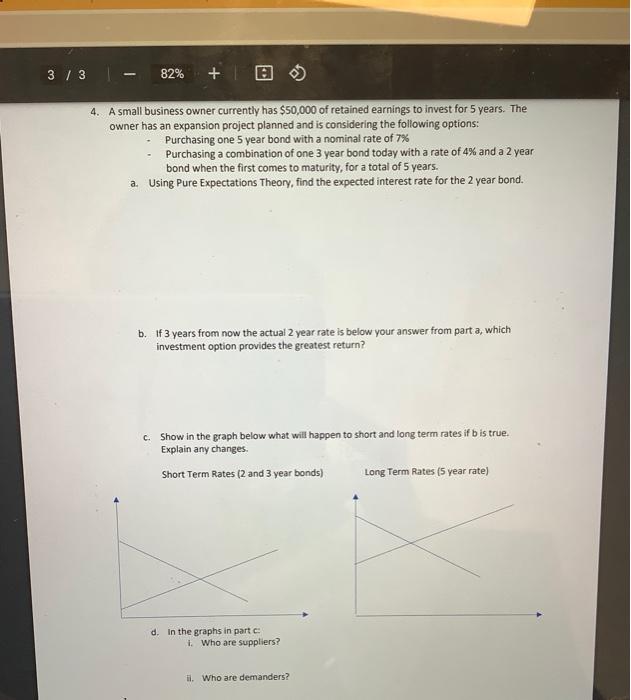

3 / 3 82% + 4. A small business owner currently has $50,000 of retained earnings to invest for 5 years. The owner has an expansion project planned and is considering the following options: Purchasing one 5 year bond with a nominal rate of 7% Purchasing a combination of one 3 year bond today with a rate of 4% and a 2 year bond when the first comes to maturity, for a total of 5 years. a. Using Pure Expectations Theory, find the expected interest rate for the 2 year bond. b. If 3 years from now the actual 2 year rate is below your answer from part a, which investment option provides the greatest return? c. Show in the graph below what will happen to short and long term rates if b is true. Explain any changes Short Term Rates (2 and 3 year bonds) Long Term Rates (5 year rate) d. In the graphs in part: i. Who are Suppliers? il Who are demanders? 3 / 3 82% + 4. A small business owner currently has $50,000 of retained earnings to invest for 5 years. The owner has an expansion project planned and is considering the following options: Purchasing one 5 year bond with a nominal rate of 7% Purchasing a combination of one 3 year bond today with a rate of 4% and a 2 year bond when the first comes to maturity, for a total of 5 years. a. Using Pure Expectations Theory, find the expected interest rate for the 2 year bond. b. If 3 years from now the actual 2 year rate is below your answer from part a, which investment option provides the greatest return? c. Show in the graph below what will happen to short and long term rates if b is true. Explain any changes Short Term Rates (2 and 3 year bonds) Long Term Rates (5 year rate) d. In the graphs in part: i. Who are Suppliers? il Who are demanders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts