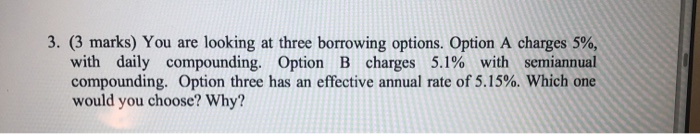

Question: 3. (3 marks) You are looking at three borrowing options. Option A charges 5%, with daily compounding. Option B charges 5.1% with semiannual compounding. Option

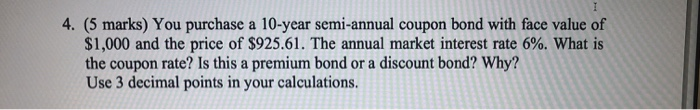

3. (3 marks) You are looking at three borrowing options. Option A charges 5%, with daily compounding. Option B charges 5.1% with semiannual compounding. Option three has an effective annual rate of 5.15%. Which one would you choose? Why? 4. (5 marks) You purchase a 10-year semi-annual coupon bond with face value of $1,000 and the price of $925.61. The annual market interest rate 6%. What is the coupon rate? Is this a premium bond or a discount bond? Why? Use 3 decimal points in your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts