Question: 3. (3 points; 1 point each; no partial credit) Swerling Company is considering a project with the following cash flows: Year Cash Flow ($20,000) $

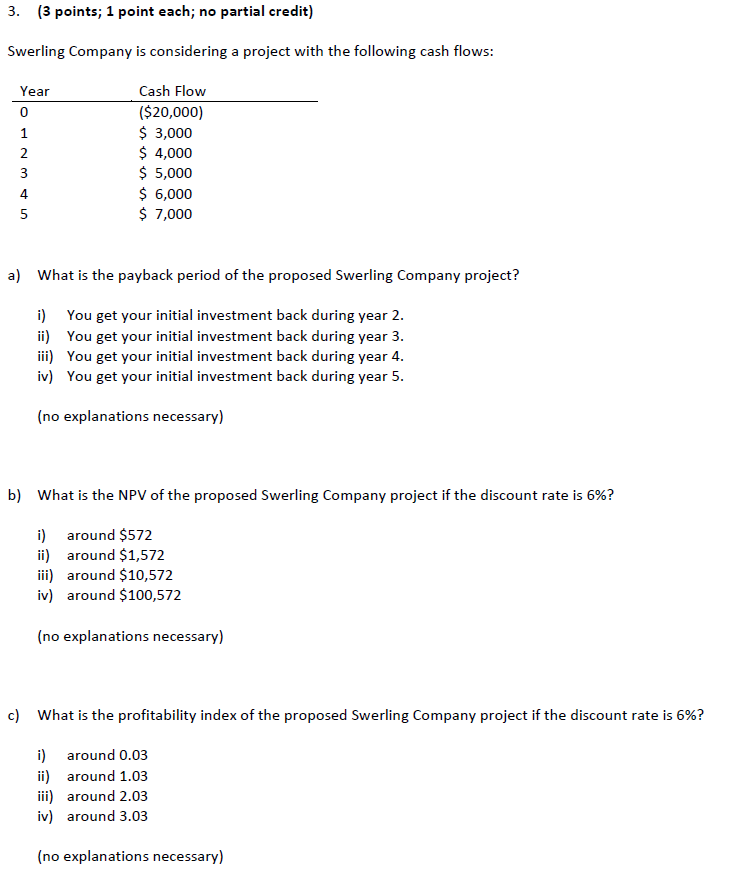

3. (3 points; 1 point each; no partial credit) Swerling Company is considering a project with the following cash flows: Year Cash Flow ($20,000) $ 3,000 $ 4,000 $ 5,000 $ 6,000 $ 7,000 a) What is the payback period of the proposed Swerling Company project? i) You get your initial investment back during year 2. ii) You get your initial investment back during year 3. iii) You get your initial investment back during year 4. iv) You get your initial investment back during year 5. (no explanations necessary) b) What is the NPV of the proposed Swerling Company project if the discount rate is 6%? i) around $572 ii) around $1,572 iii) around $10,572 iv) around $100,572 (no explanations necessary) c) What is the profitability index of the proposed Swerling Company project if the discount rate is 6%? i) around 0.03 ii) around 1.03 iii) around 2.03 iv) around 3.03 (no explanations necessary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts