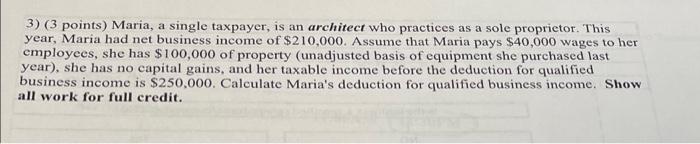

Question: 3) (3 points) Maria, a single taxpayer, is an architect who practices as a sole proprietor. This year, Maria had net business income of $210,000.

3) (3 points) Maria, a single taxpayer, is an architect who practices as a sole proprietor. This year, Maria had net business income of $210,000. Assume that Maria pays $40,000 wages to her employees, she has $100,000 of property (unadjusted basis of equipment she purchased last year), she has no capital gains, and her taxable income before the deduction for qualified business income is $250,000. Calculate Maria's deduction for qualified business income. Show all work for full credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts