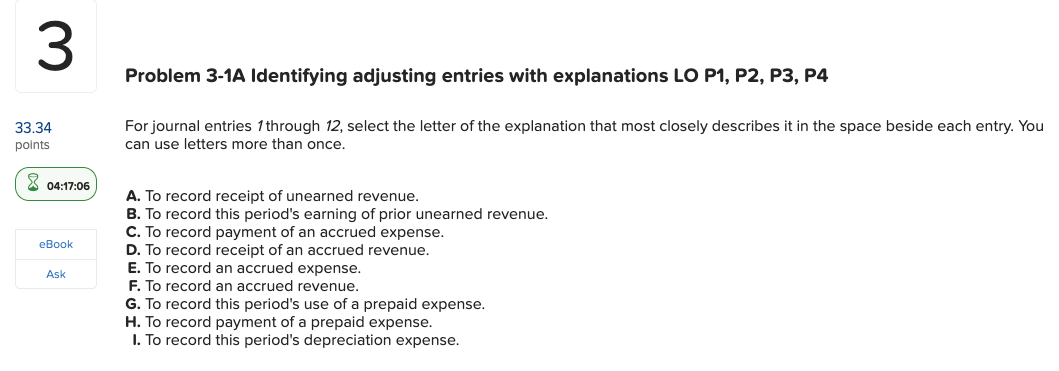

Question: 3 3 Problem 3-1A Identifying adjusting entries with explanations LO P1, P2, P3, P4 33.34 points For journal entries 1 through 12, select the letter

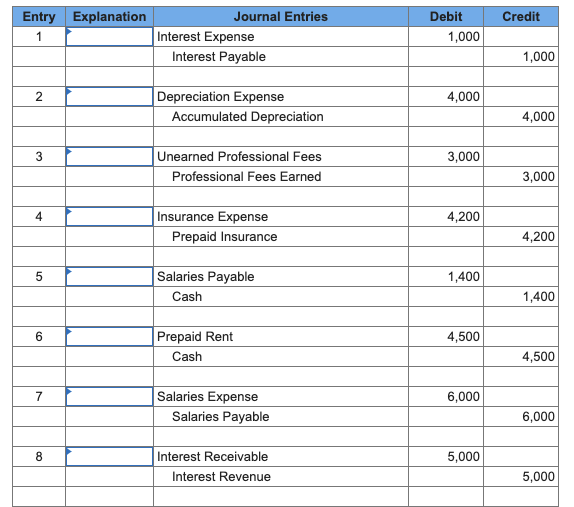

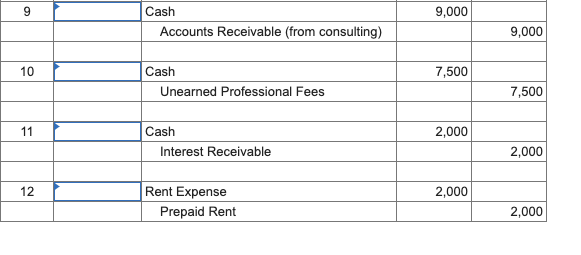

3 3 Problem 3-1A Identifying adjusting entries with explanations LO P1, P2, P3, P4 33.34 points For journal entries 1 through 12, select the letter of the explanation that most closely describes it in the space beside each entry. You can use letters more than once. 8 04:17:06 eBook A. To record receipt of unearned revenue. B. To record this period's earning of prior unearned revenue. C. To record payment of an accrued expense. D. To record receipt of an accrued revenue. E. To record an accrued expense. F. To record an accrued revenue. G. To record this period's use of a prepaid expense. H. To record payment of a prepaid expense. I. To record this period's depreciation expense. Ask Debit Credit Entry Explanation Journal Entries Interest Expense Interest Payable 1 1,000 1,000 N 4,000 Depreciation Expense Accumulated Depreciation 4,000 3 Unearned Professional Fees 3,000 Professional Fees Earned 3,000 4 4,200 Insurance Expense Prepaid Insurance 4,200 5 Salaries Payable 1,400 Cash 1,400 6 Prepaid Rent 4,500 Cash 4,500 7 6,000 Salaries Expense Salaries Payable 6,000 8 Interest Receivable 5,000 Interest Revenue 5,000 9 Cash 9,000 Accounts Receivable (from consulting) 9,000 10 Cash 7,500 Unearned Professional Fees 7,500 11 Cash 2,000 Interest Receivable 2,000 12 2,000 Rent Expense Prepaid Rent 2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts