Question: 3. (30 points) Consider the standard consumer problem we have been studying, in 1which a consumer has to choose consumption of two goods c1 and

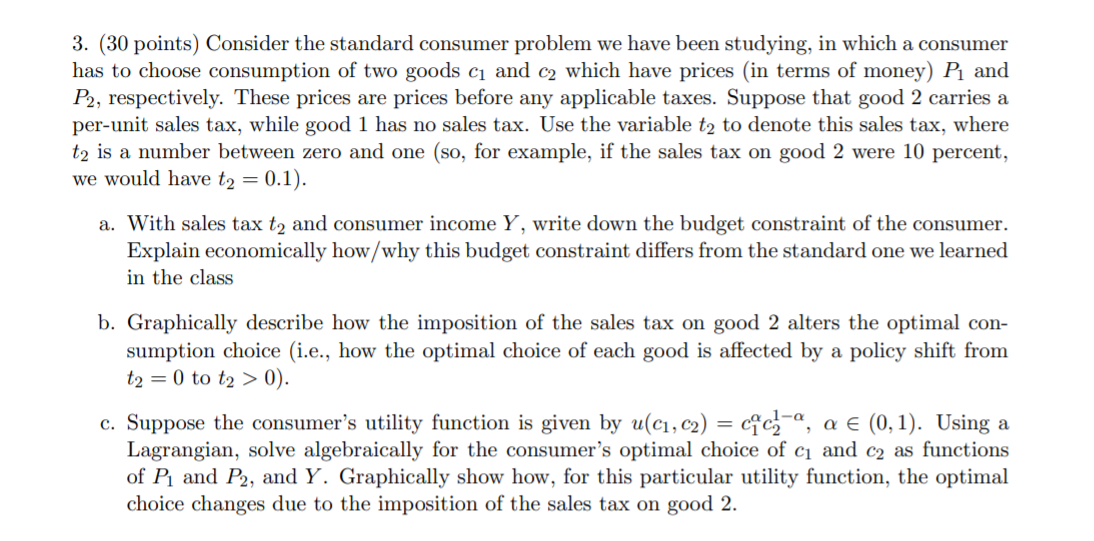

3. (30 points) Consider the standard consumer problem we have been studying, in 1which a consumer has to choose consumption of two goods c1 and 02 which have prices (in terms of money) P1 and Pb, respectively. These prices are prices before any applicable taxes. Suppose that good 2 carries a perunit sales tax, while good 1 has no sales tax. Use the variable t: to denote this sales tax, where t2 is a number between zero and one (so, for example, if the sales tax on good 2 were 10 percent, we would have t; = 0.1]. a. With sales tax t2 and consumer income Y, write down the budget constraint of the consumer. Explain economically how/ why this budget constraint di'ers from the standard one we learned in the class b. Graphically describe how the imposition of the sales tax on good 2 alters the optimal con- sumption choice (i.e., how the optimal choice of each good is affected by a policy shift from t2=0t02>0). c. Suppose the consumer's utility function is given by u(c1,r:2) = c'fc'\

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts