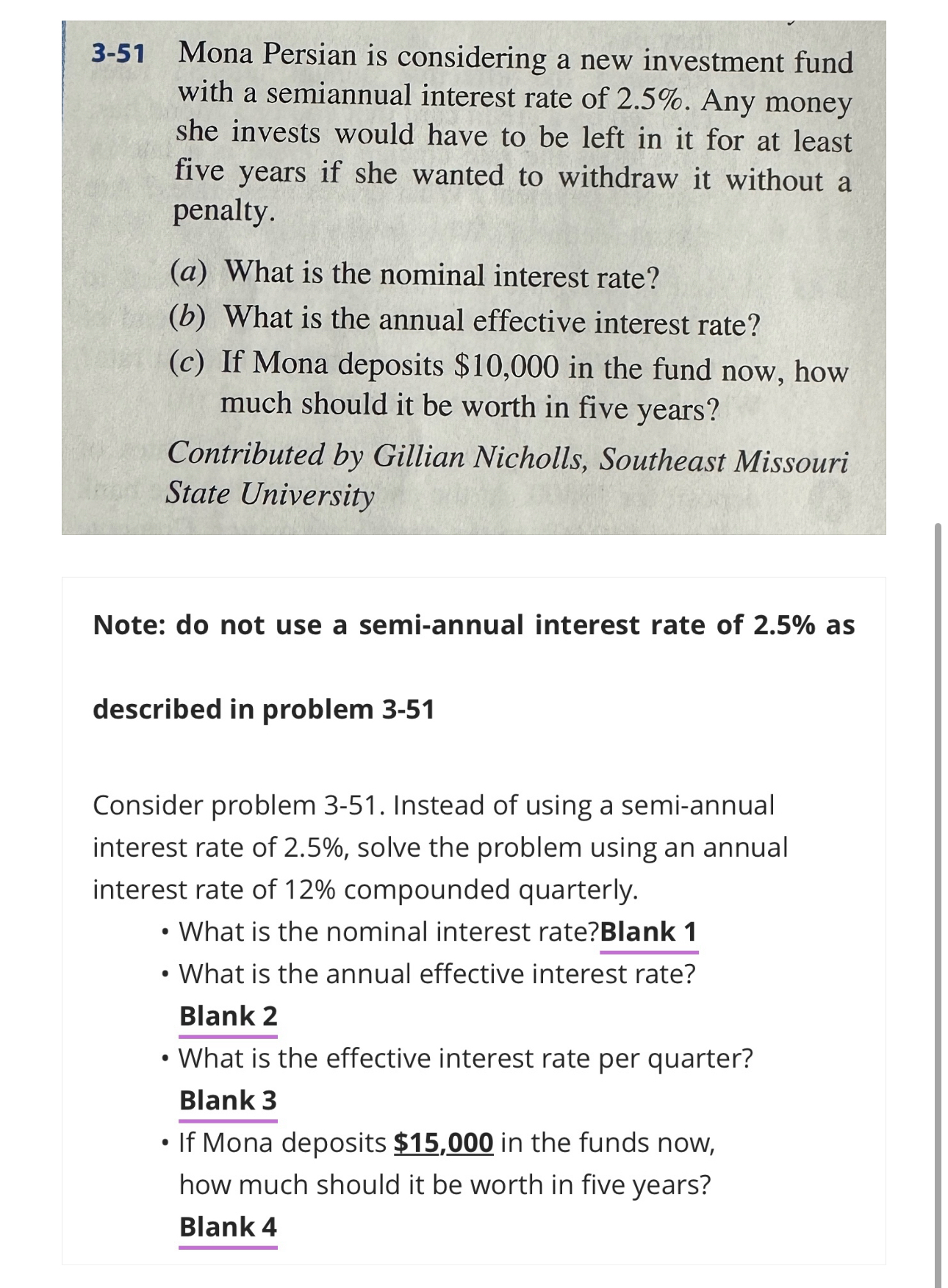

Question: 3 - 5 1 Mona Persian is considering a new investment fund with a semiannual interest rate of 2 . 5 % . Any money

Mona Persian is considering a new investment fund with a semiannual interest rate of Any money she invests would have to be left in it for at least five years if she wanted to withdraw it without a penalty.

a What is the nominal interest rate?

b What is the annual effective interest rate?

c If Mona deposits $ in the fund now, how much should it be worth in five years?

Contributed by Gillian Nicholls, Southeast Missouri

State University

Note: do not use a semiannual interest rate of as

described in problem

Consider problem Instead of using a semiannual interest rate of solve the problem using an annual interest rate of compounded quarterly.

What is the nominal interest rate?Blank

What is the annual effective interest rate?

Blank

What is the effective interest rate per quarter?

Blank

If Mona deposits $ in the funds now, how much should it be worth in five years?

Blank

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock