Question: (3) (5 points) Consider the CAPM. The expected return on the market is 18%. The expected return on a stock with a beta of 1.2

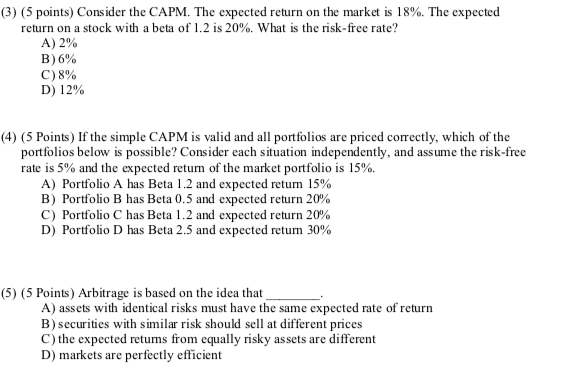

(3) (5 points) Consider the CAPM. The expected return on the market is 18%. The expected return on a stock with a beta of 1.2 is 20%. What is the risk-free rate? A) 2% B) 6% C)8% D) 12% (4) (5 Points) If the simple CAPM is valid and all portfolios are priced correctly, which of the portfolios below is possible? Consider each situation independently, and assume the risk-free rate is 5% and the expected return of the market portfolio is 15%. A) Portfolio A has Beta 1.2 and expected return 15% B) Portfolio B has Beta 0.5 and expected return 20% C) Portfolio C has Beta 1.2 and expected return 20% D) Portfolio D has Beta 2.5 and expected return 30% (5) (5 Points) Arbitrage is based on the idea that A) assets with identical risks must have the same expected rate of return B) securities with similar risk should sell at different prices C) the expected returns from equally risky assets are different D) markets are perfectly efficient

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts