Question: 3. (5 points) Nebula Corp's most recent earnings before interest and taxes (EBIT) lion. They increased their net working capital by $5 million and invested

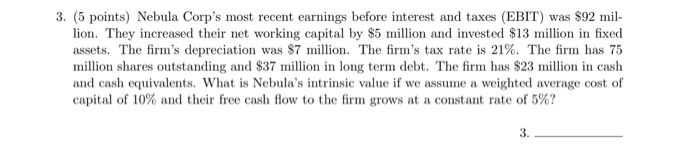

3. (5 points) Nebula Corp's most recent earnings before interest and taxes (EBIT) lion. They increased their net working capital by $5 million and invested $13 million in fixed assets. The firm's depreciation was $7 million. The firm's tax rate is 21%. The firm has 75 million shares outstanding and $37 million in long term debt. The firm has $23 million in cash and cash equivalents. What is Nebula's intrinsic value if we assume a weighted average cost of capital of 10% and their free cash flow to the firm grows at a constant rate of 5%? was $92 mil- 3

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock