Question: 3. (5 points) Suppose in an accounts payable hedging problem the breakeven exchange rate between the call option and forward market hedge is $1.14/euro. If

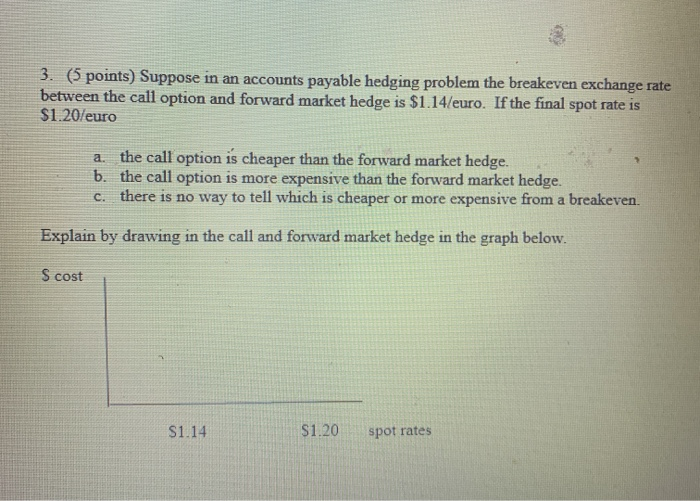

3. (5 points) Suppose in an accounts payable hedging problem the breakeven exchange rate between the call option and forward market hedge is $1.14/euro. If the final spot rate is $1.20/euro a. the call option is cheaper than the forward market hedge. b. the call option is more expensive than the forward market hedge. c. there is no way to tell which is cheaper or more expensive from a breakeven. Explain by drawing in the call and forward market hedge in the graph below. S cost $1.14 $1.20 spot rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts