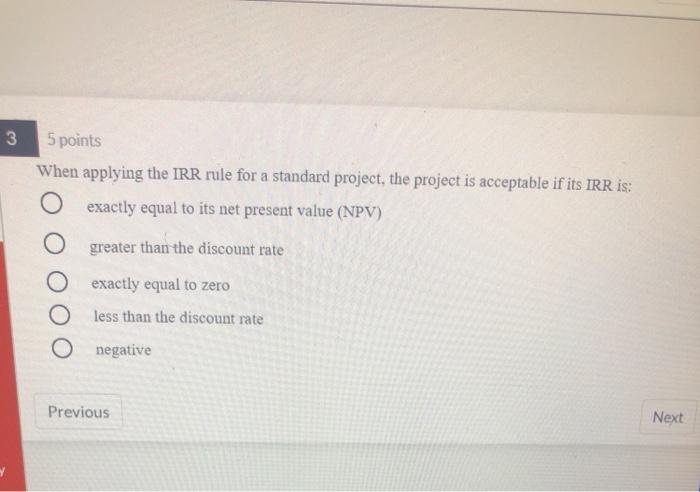

Question: 3 5 points When applying the IRR rule for a standard project, the project is acceptable if its IRR is: exactly equal to its net

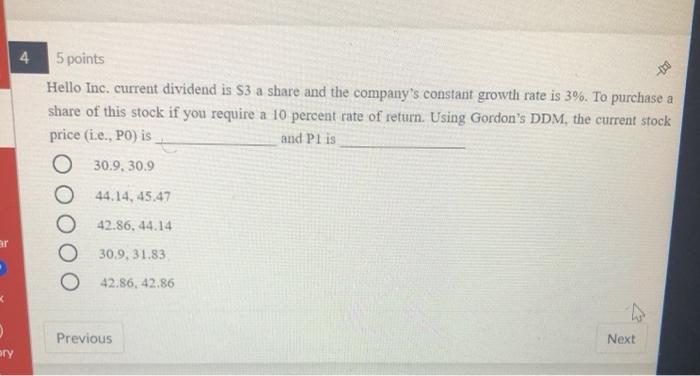

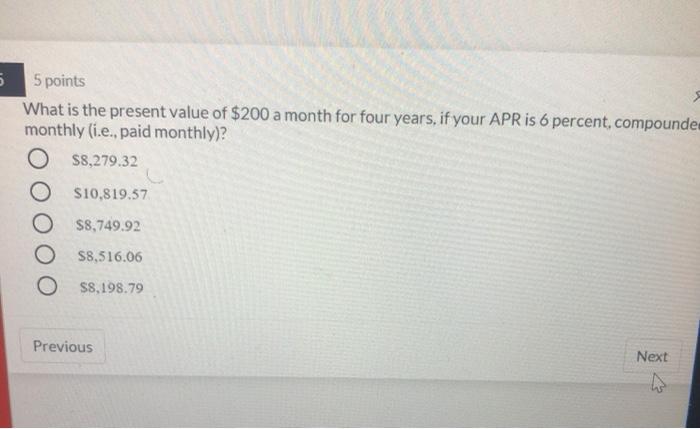

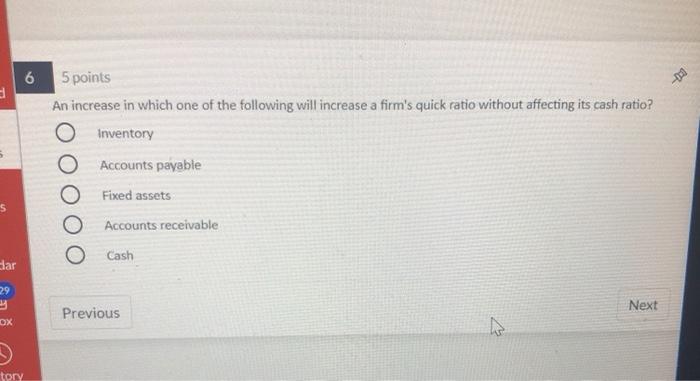

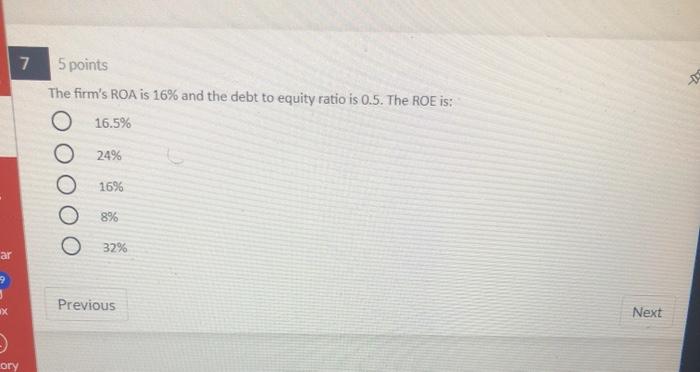

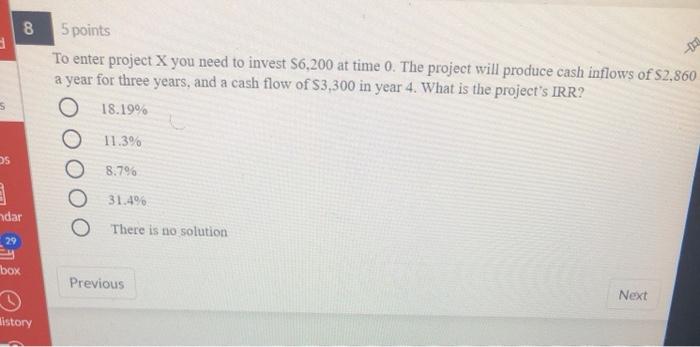

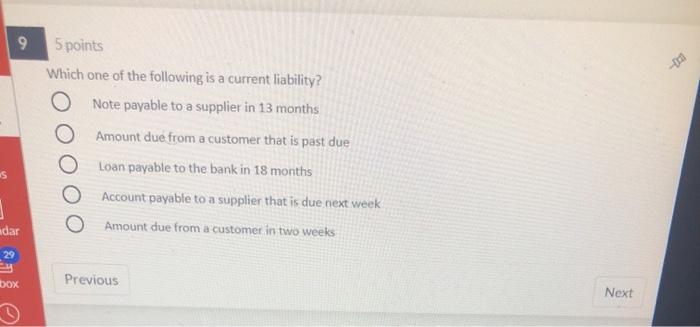

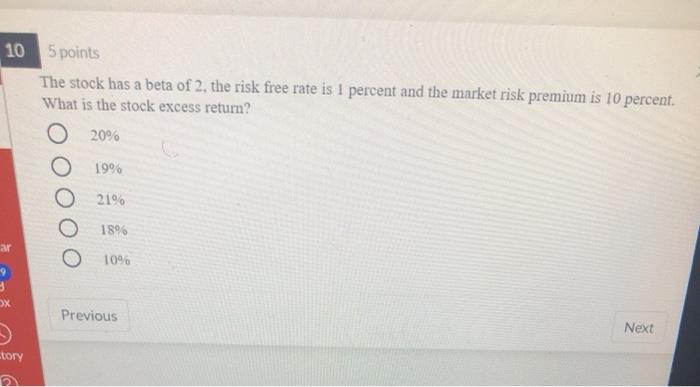

3 5 points When applying the IRR rule for a standard project, the project is acceptable if its IRR is: exactly equal to its net present value (NPV) greater than the discount rate O exactly equal to zero less than the discount rate negative Previous Next 4 5 points Hello Inc. current dividend is $3 a share and the company's constant growth rate is 3%. To purchase a share of this stock if you require a 10 percent rate of return. Using Gordon's DDM, the current stock price (i.e., PO) is and Pl is O 30.9. 30.9 O 44.14.45.47 42.86. 44.14 ar 30.9. 31.83 42.86, 42.86 Previous Next Dry 5 5 points What is the present value of $200 a month for four years, if your APR is 6 percent, compounde monthly (i.e., paid monthly)? O $8,279.32 $10,819.57 O $8,749.92 $8,516.06 O $8,198.79 Previous Next 6 -10 5 points An increase in which one of the following will increase a firm's quick ratio without affecting its cash ratio? Inventory O Accounts payable O Fixed assets Accounts receivable Cash dlar 29 Next Previous OX tory 7 2 5 points The firm's ROA is 16% and the debt to equity ratio is 0.5. The ROE is: O 16.5% O 24% 16% 8% O 32% ar Previous Next ory 8 8 5 points To enter project X you need to invest S6,200 at time 0. The project will produce cash inflows of 52,860 a year for three years, and a cash flow of $3,300 in year 4. What is the project's IRR? O 18.19% O 11.3% OS 8.7% ndar O 31.4% O There is no solution 29 box Previous Next listory 9 5 points Which one of the following is a current liability? O Note payable to a supplier in 13 months Amount due from a customer that is past due Loan payable to the bank in 18 months O Account payable to a supplier that is due next week. Amount due from a customer in two weeks "S dar DOX Previous Next 10 5 points The stock has a beta of 2, the risk free rate is 1 percent and the market risk premium is 10 percent. What is the stock excess return? 20% 19% 21% 18% ar 10% OX Previous Next story

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts