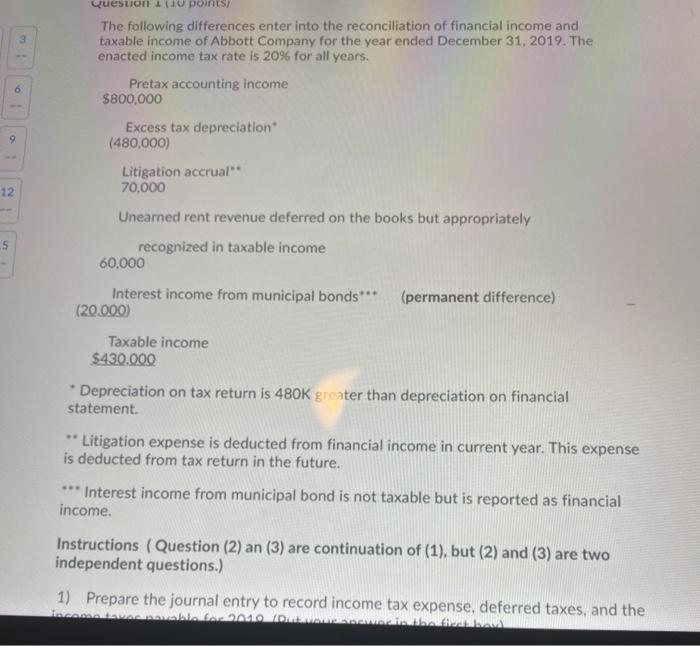

Question: 3 6 Question I points) The following differences enter into the reconciliation of financial income and taxable income of Abbott Company for the year ended

3 6 Question I points) The following differences enter into the reconciliation of financial income and taxable income of Abbott Company for the year ended December 31, 2019. The enacted income tax rate is 20% for all years. Pretax accounting income $800,000 Excess tax depreciation (480,000) Litigation accrual" 70,000 9 -12 Unearned rent revenue deferred on the books but appropriately recognized in taxable income 60,000 5 Interest income from municipal bonds*** (20.000) (permanent difference) Taxable income $430,000 Depreciation on tax return is 480K greater than depreciation on financial statement. * Litigation expense is deducted from financial income in current year. This expense is deducted from tax return in the future. *** Interest income from municipal bond is not taxable but is reported as financial income. Instructions (Question (2) an (3) are continuation of (1), but (2) and (3) are two independent questions.) 1) Prepare the journal entry to record income tax expense, deferred taxes, and the Inc. Who W Swedba Financial income in current year. This expense is deducted from tax return in the future. *** Interest income from municipal bond is not taxable but is reported as financial income. Instructions (Question (2) an (3) are continuation of (1), but (2) and (3) are two independent questions.) 1) Prepare the journal entry to record income tax expense, deferred taxes, and the income taxes payable for 2019. (Put your answer in the first box) 2) Assuming all the temporary differences (excess tax depreciation, litigation liability, and rent revenue ) will reverse in 2020. Assuming taxable income of 2020 is $1,150,000, and no new temporary or permanent difference occurs, prepare journal entry to record income tax expense, deferred tax adjustment, and the income taxes payable for 2020. (Put your answer in the second box) 3) Assuming the temporary differences (excess tax depreciation, litigation liability, and rent revenue ) will reverse evenly in 2020 and 2021. Assuming taxable income of 2020 is $1,150,000, and no new temporary or permanent difference occurs, prepare journal entry to record income tax expense, deferred tax adjustment, and the income taxes payable for 2020. (Put your answer in the third box)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts