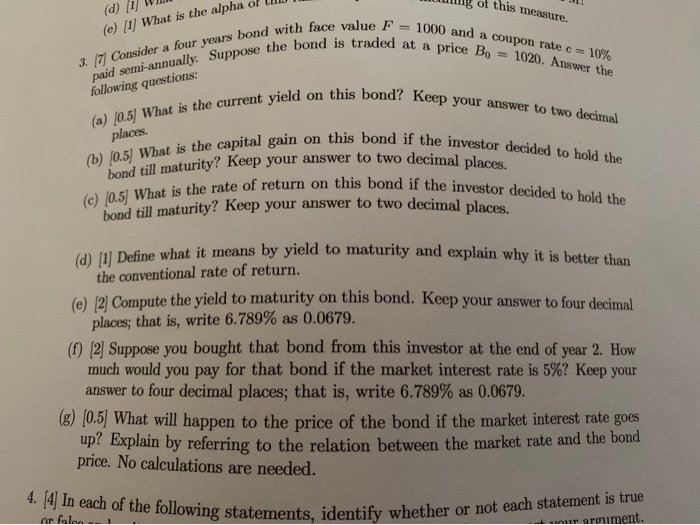

Question: 3. /7/ Consider a four years bond with face value F = 1000 and a coupon rate ca paid semi-annually. Suppose the bond is traded

3. /7/ Consider a four years bond with face value F = 1000 and a coupon rate ca paid semi-annually. Suppose the bond is traded at a (a) (0.5) What is the current yield on this bond? Keep your answer to two decimal (b) (0.5) What is the capital gain on this bond if the investor decided to hold the bond till maturity? Keep your answer to two decimal places. (C) (0.5) What is the rate of return on this bond if the investor decided to hold the this measure. (d) (1 (e) (1) What is the alpha price B 10% 1020. Answer the following questions: places. bond till maturity? Keep your answer to two decimal places. 4. 4 In each of the following statements, identify whether or not each statement is true (d) [1] Define what it means by yield to maturity and explain why it is better than the conventional rate of return. (e) (2) Compute the yield to maturity on this bond. Keep your answer to four decimal places; that is, write 6.789% as 0.0679. (f) [2] Suppose you bought that bond from this investor at the end of year 2. How much would you pay for that bond if the market interest rate is 5%? Keep your answer to four decimal places; that is, write 6.789% as 0.0679. (8) (0.5) What will happen to the price of the bond if the market interest rate goes up? Explain by referring to the relation between the market rate and the bond price. No calculations are needed. ar falan w aroument

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts