Question: 3 7 . For a new process, the land was purchased for ( $ 1 0 ) million. The fixed capital investment,

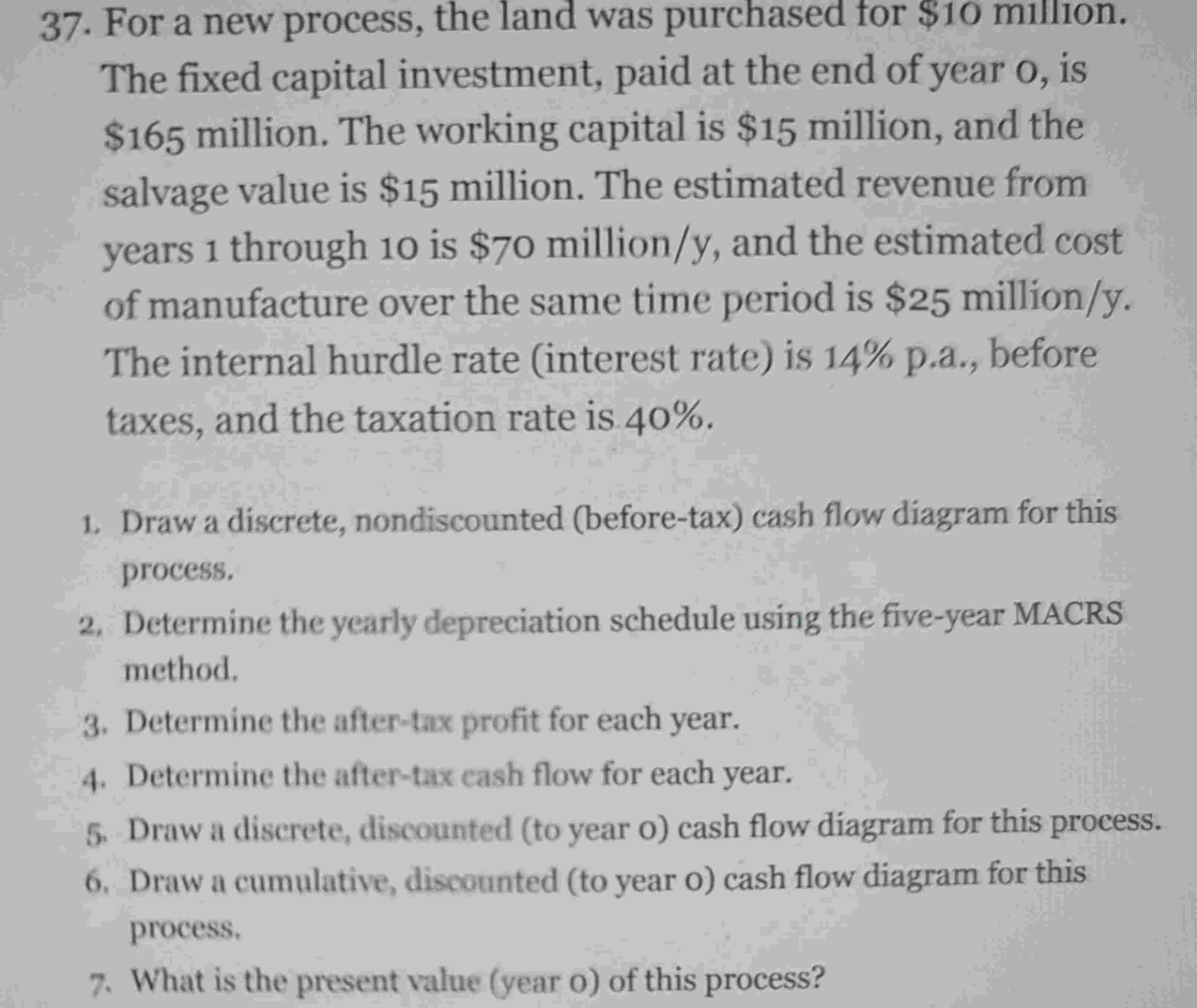

For a new process, the land was purchased for $ million. The fixed capital investment, paid at the end of year is $ million. The working capital is $ million, and the salvage value is $ million. The estimated revenue from years through is $ milliony and the estimated cost of manufacture over the same time period is $ milliony The internal hurdle rate interest rate is pa before taxes, and the taxation rate is Draw a discrete, nondiscounted beforetax cash flow diagram for this process. Determine the yearly depreciation schedule using the fiveyear MACRS method. Determine the aftertax profit for each year. Determine the aftertax cash flow for each year. Draw a discrete, discounted to year o cash flow diagram for this process. Draw a cumulative, discounted to year o cash flow diagram for this process. What is the present value year of this process?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock