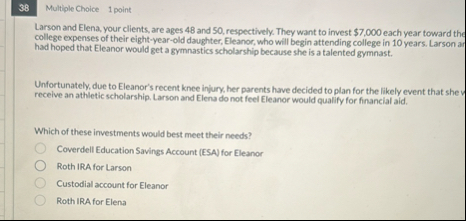

Question: 3 8 Multiple Choice 1 point Larson and Elena, your clients, are ages 4 8 and 5 0 , respectively. They want to invest $

Multiple Choice

point

Larson and Elena, your clients, are ages and respectively. They want to invest $ each year toward the college expenses of their eightyearold daughter, Eleanor, who will begin attending college in years. Larson ar had hoped that Eleanor would get a gymnastics scholarship because she is a talented gymnast.

Unfortunately, due to Eleanor's recent knee injury, her parents have decided to plan for the likely event that she receive an athletic scholarship. Larson and Elena do not feel Eleanor would qualify for financial aid.

Which of these investments would best meet their needs?

Coverdell Education Savings Account ESA for Eleanor

Roth IRA for Larson

Custodial account for Eleanor

Roth IRA for Elena

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock