Question: 3 9 VIEW A Read aloud V Draw Tafford Ltd The following is an extract from the trial balance of Tafford, a limited liability company,

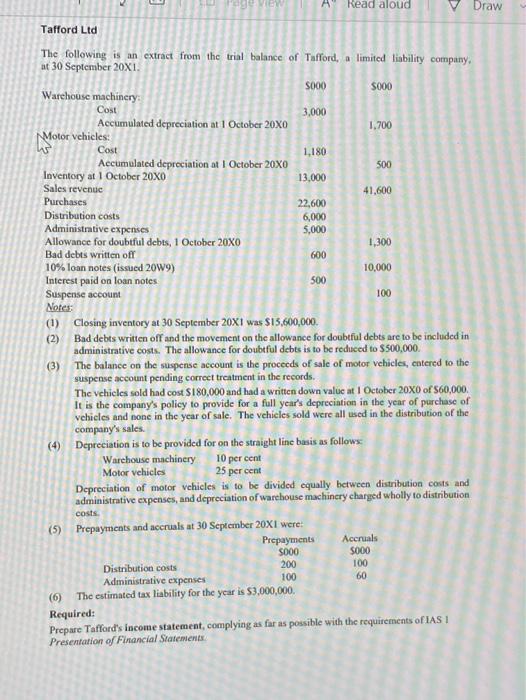

3 9 VIEW A Read aloud V Draw Tafford Ltd The following is an extract from the trial balance of Tafford, a limited liability company, at 30 September 20X1. S000 5000 Warehouse machinery Cost 3,000 Accumulated depreciation at 1 October 20X0 1.700 Motor vehicles: Cost 1,180 Accumulated depreciation at 1 October 20X0 500 Inventory at 1 October 20X0 13.000 Sales revenue 41.600 Purchases 22,600 Distribution costs 6,000 Administrative expenses 5,000 Allowance for doubtful debts, 1 October 20X0 1,300 Bad debts written off 600 10% loan notes (issued 2009) 10,000 Interest paid on loan notes 500 Suspense account 100 Notes: (1) Closing inventory at 30 September 20X1 was $15,600,000 (2) Bad debts written off and the movement on the allowance for doubtful debts are to be included in administrative costs. The allowance for doubtful debts is to be reduced to $500,000 (3) The balance on the suspense account is the proceeds of sale of motor vehicles, entered to the suspense account pending correct treatment in the records. The vehicles sold had cost $180,000 and had a written down value at 1 October 20X0 of 60,000 It is the company's policy to provide for a full year's depreciation in the year of purchase of vehicles and none in the year of sale. The vehicles sold were all used in the distribution of the company's sales (4) Depreciation is to be provided for on the straight line basis as follows Warehouse machinery 10 per cent Motor vehicles 25 per cent Depreciation of motor vehicles is to be divided equally between distribution costs and administrative expenses, and depreciation of warehouse machinery charged wholly to distribution (5) Prepayments and accruals at 30 September 20X1 were: Prepayments Accruals S000 5000 Distribution costs 200 100 Administrative expenses 100 60 (6) The estimated tax liability for the year is $3,000,000 Required: Prepare Tafford's income statement, complying as far as possible with the requirements of IASI Presentation of Financial Statements. costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts