Question: 3. (a) A company is considering purchasing a machine for 160,000. The machine has a maintenance cost of 10,000 in year 3 and an anticipated

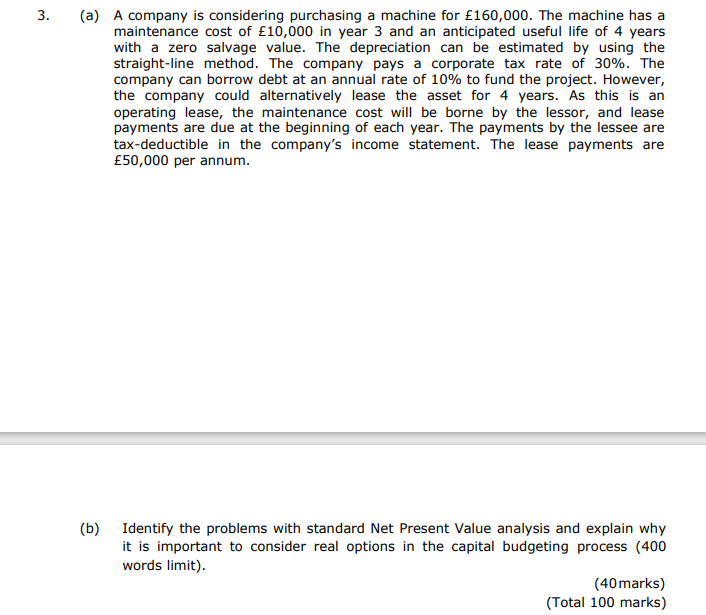

3. (a) A company is considering purchasing a machine for 160,000. The machine has a maintenance cost of 10,000 in year 3 and an anticipated useful life of 4 years with a zero salvage value. The depreciation can be estimated by using the straight-line method. The company pays a corporate tax rate of 30%. The company can borrow debt at an annual rate of 10% to fund the project. However, the company could alternatively lease the asset for 4 years. As this is an operating lease, the maintenance cost will be borne by the lessor, and lease payments are due at the beginning of each year. The payments by the lessee are tax-deductible in the company's income statement. The lease payments are 50,000 per annum. (b) Identify the problems with standard Net Present Value analysis and explain why it is important to consider real options in the capital budgeting process (400 words limit). (40marks) (Total 100 marks) 3. (a) A company is considering purchasing a machine for 160,000. The machine has a maintenance cost of 10,000 in year 3 and an anticipated useful life of 4 years with a zero salvage value. The depreciation can be estimated by using the straight-line method. The company pays a corporate tax rate of 30%. The company can borrow debt at an annual rate of 10% to fund the project. However, the company could alternatively lease the asset for 4 years. As this is an operating lease, the maintenance cost will be borne by the lessor, and lease payments are due at the beginning of each year. The payments by the lessee are tax-deductible in the company's income statement. The lease payments are 50,000 per annum. (b) Identify the problems with standard Net Present Value analysis and explain why it is important to consider real options in the capital budgeting process (400 words limit). (40marks) (Total 100 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts