Question: 3. (a) A project will generate a cash flow after one year. The value of the cash flow is contingent on the state of the

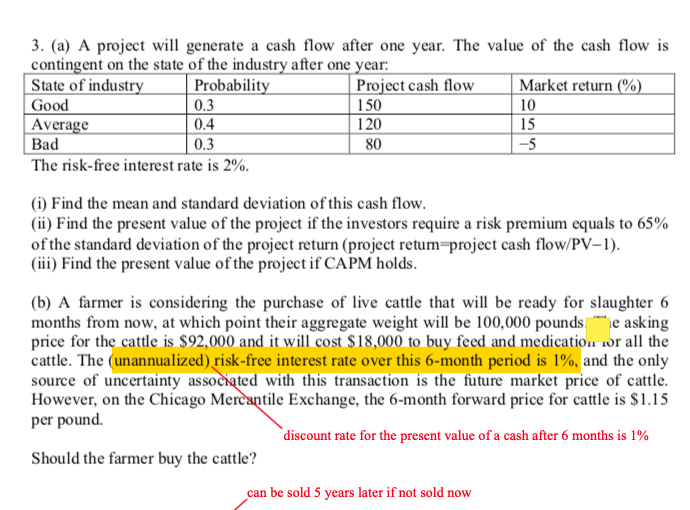

3. (a) A project will generate a cash flow after one year. The value of the cash flow is contingent on the state of the industry after one year: State of industry Probability Project cash flow Market return (%) Good 0.3 150 10 Average 0.4 120 15 Bad 0.3 80 The risk-free interest rate is 2%. (1) Find the mean and standard deviation of this cash flow. (ii) Find the present value of the project if the investors require a risk premium equals to 65% of the standard deviation of the project return (project retum-project cash flow/PV-1). (iii) Find the present value of the project if CAPM holds. (b) A farmer is considering the purchase of live cattle that will be ready for slaughter 6 months from now, at which point their aggregate weight will be 100,000 pounds he asking price for the cattle is $92,000 and it will cost $18,000 to buy feed and medication or all the cattle. The (unannualized) risk-free interest rate over this 6-month period is 1%, and the only source of uncertainty associated with this transaction is the future market price of cattle. However, on the Chicago Mercantile Exchange, the 6-month forward price for cattle is $1.15 per pound. discount rate for the present value of a cash after 6 months is 1% Should the farmer buy the cattle? can be sold 5 years later if not sold now 3. (a) A project will generate a cash flow after one year. The value of the cash flow is contingent on the state of the industry after one year: State of industry Probability Project cash flow Market return (%) Good 0.3 150 10 Average 0.4 120 15 Bad 0.3 80 The risk-free interest rate is 2%. (1) Find the mean and standard deviation of this cash flow. (ii) Find the present value of the project if the investors require a risk premium equals to 65% of the standard deviation of the project return (project retum-project cash flow/PV-1). (iii) Find the present value of the project if CAPM holds. (b) A farmer is considering the purchase of live cattle that will be ready for slaughter 6 months from now, at which point their aggregate weight will be 100,000 pounds he asking price for the cattle is $92,000 and it will cost $18,000 to buy feed and medication or all the cattle. The (unannualized) risk-free interest rate over this 6-month period is 1%, and the only source of uncertainty associated with this transaction is the future market price of cattle. However, on the Chicago Mercantile Exchange, the 6-month forward price for cattle is $1.15 per pound. discount rate for the present value of a cash after 6 months is 1% Should the farmer buy the cattle? can be sold 5 years later if not sold now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts