Question: 3 (a) A three-year multiple step-up note has the following coupon rate (annual but payable semi-annually) structure: 1% in Year 1, 2% in Year 2,

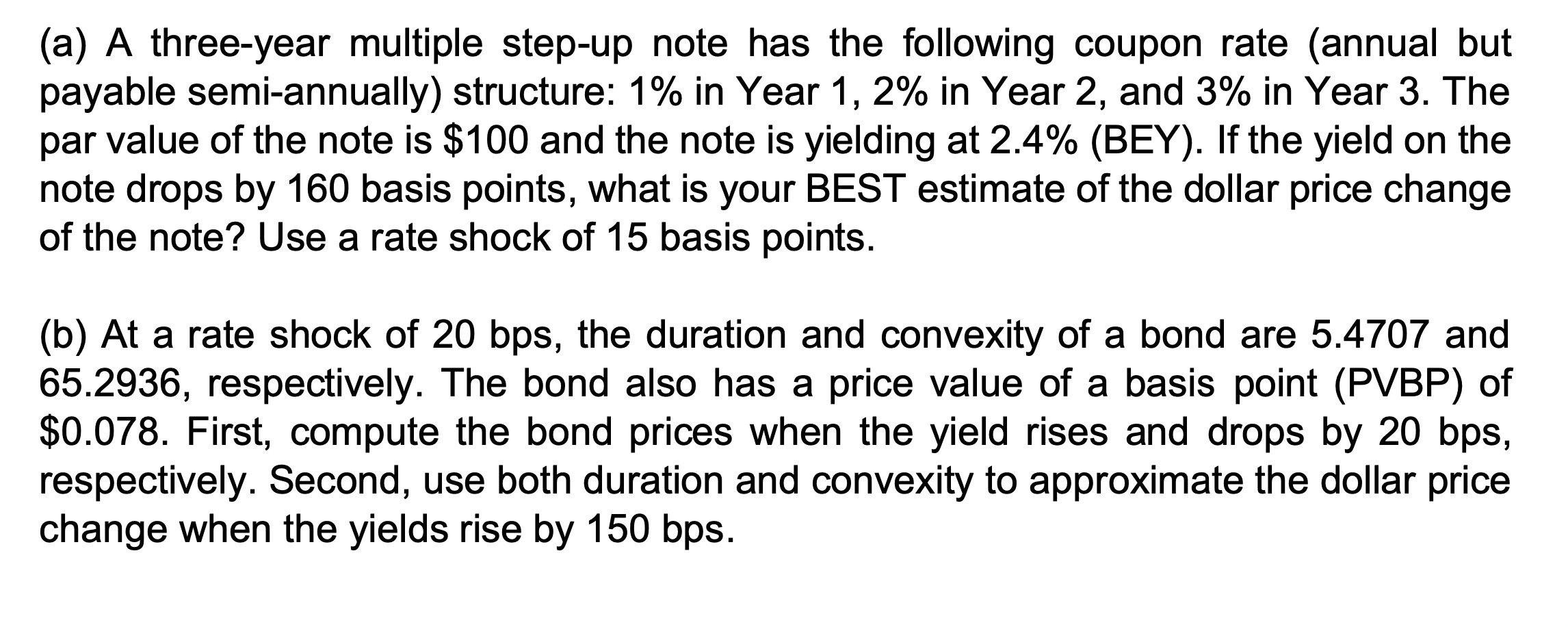

3 (a) A three-year multiple step-up note has the following coupon rate (annual but payable semi-annually) structure: 1% in Year 1, 2% in Year 2, and 3% in Year 3. The par value of the note is $100 and the note is yielding at 2.4% (BEY). If the yield on the note drops by 160 basis points, what is your BEST estimate of the dollar price change of the note? Use a rate shock of 15 basis points. (b) At a rate shock of 20 bps, the duration and convexity of a bond are 5.4707 and 65.2936, respectively. The bond also has a price value of a basis point (PVBP) of $0.078. First, compute the bond prices when the yield rises and drops by 20 bps, respectively. Second, use both duration and convexity to approximate the dollar price change when the yields rise by 150 bps. 3 (a) A three-year multiple step-up note has the following coupon rate (annual but payable semi-annually) structure: 1% in Year 1, 2% in Year 2, and 3% in Year 3. The par value of the note is $100 and the note is yielding at 2.4% (BEY). If the yield on the note drops by 160 basis points, what is your BEST estimate of the dollar price change of the note? Use a rate shock of 15 basis points. (b) At a rate shock of 20 bps, the duration and convexity of a bond are 5.4707 and 65.2936, respectively. The bond also has a price value of a basis point (PVBP) of $0.078. First, compute the bond prices when the yield rises and drops by 20 bps, respectively. Second, use both duration and convexity to approximate the dollar price change when the yields rise by 150 bps

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts