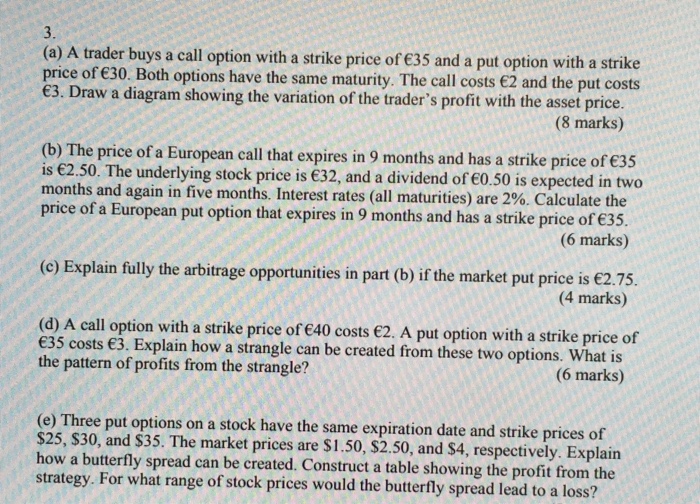

Question: 3. (a) A trader buys a call option with a strike price of E35 and a put option with a strike price of 30. Both

3. (a) A trader buys a call option with a strike price of E35 and a put option with a strike price of 30. Both options have the same maturity. The call costs 2 and the put costs 3. Draw a diagram showing the variation of the trader's profit with the asset price. (8 marks) (b) The price of a European call that expires in 9 months and has a strike price of is 2.50. The underlying stock price is 32, and a dividend of 0.50 is expected in two months and again in five months. Interest rates (all maturities) are 2%. Calculate the price of a European put option that expires in 9 months and has a strike price of e35. (6 marks) ies in part (b) if the market put price is 2.75. (4 marks) (d) A call option with a strike price of 40 costs 2. A put option with a strike price of 35 costs 3. Explain how a strangle can be created from these two options. What is the pattern of profits from the strangle? (6 marks) (e) Three put options on a stock have the same expiration date and strike prices of $25, $30, and $35. The market prices are $1.50, $2.50, and S4, respectively. Explain how a butterfly spread can be created. Construct a table showing the profit from the strategy. For what range of stock prices would the butterfly spread lead to a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts