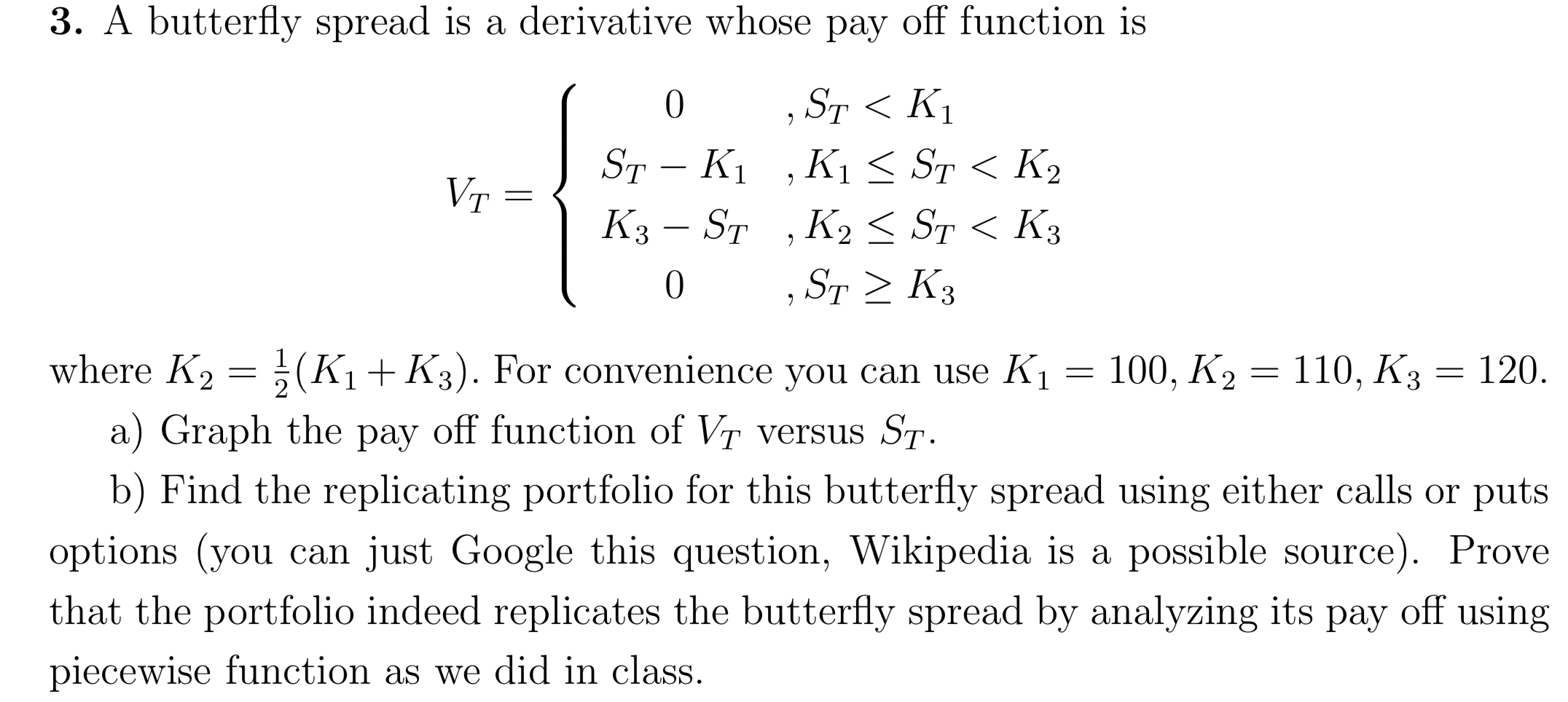

Question: 3. A butterfly spread is a derivative whose pay off function is 0 ST K3 where K2 = }(K1+K3). For convenience you can use K1

3. A butterfly spread is a derivative whose pay off function is 0 ST K3 where K2 = }(K1+K3). For convenience you can use K1 = 100, K2 = 110, K3 = 120. a) Graph the pay off function of V versus St. b) Find the replicating portfolio for this butterfly spread using either calls or puts options (you can just Google this question, Wikipedia is a possible source). Prove that the portfolio indeed replicates the butterfly spread by analyzing its pay off using piecewise function as we did in class. 3. A butterfly spread is a derivative whose pay off function is 0 ST K3 where K2 = }(K1+K3). For convenience you can use K1 = 100, K2 = 110, K3 = 120. a) Graph the pay off function of V versus St. b) Find the replicating portfolio for this butterfly spread using either calls or puts options (you can just Google this question, Wikipedia is a possible source). Prove that the portfolio indeed replicates the butterfly spread by analyzing its pay off using piecewise function as we did in class

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts