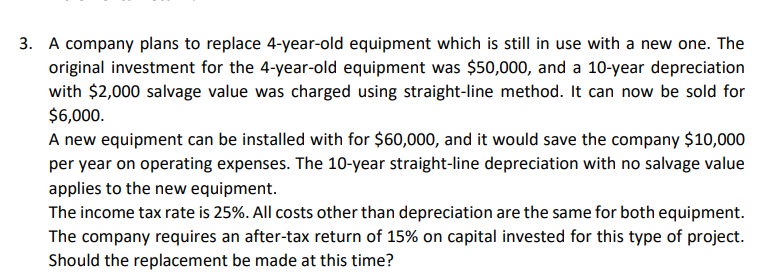

Question: 3 . A company plans to replace 4 - year - old equipment which is still in use with a new one. The original investment

A company plans to replace yearold equipment which is still in use with a new one. The original investment for the yearold equipment was $ and a year depreciation with $ salvage value was charged using straightline method. It can now be sold for $

A new equipment can be installed with for $ and it would save the company $ per year on operating expenses. The year straightline depreciation with no salvage value applies to the new equipment.

The income tax rate is All costs other than depreciation are the same for both equipment. The company requires an aftertax return of on capital invested for this type of project. Should the replacement be made at this time?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock