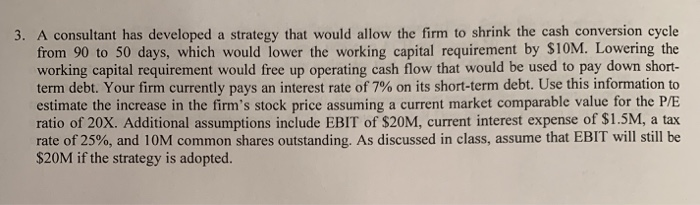

Question: 3. A consultant has developed a strategy that would allow the firm to shrink the cash conversion cycle from 90 to 50 days, which would

3. A consultant has developed a strategy that would allow the firm to shrink the cash conversion cycle from 90 to 50 days, which would lower the working capital requirement by $10M. Lowering the working capital requirement would free up operating cash flow that would be used to pay down short- term debt. Your firm currently pays an interest rate of 7% on its short-term debt. Use this information to estimate the increase in the firm's stock price assuming a current market comparable value for the P/E ratio of 20X. Additional assumptions include EBIT of $20M, current interest expense of $1.5M, a tax rate of 25%, and 10M common shares outstanding. As discussed in class, assume that EBIT will still be $20M if the strategy is adopted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts