Question: 3) A Contingent liability is a potential rather than an actual liability because its depends on a future event. Some event must happen( the contingency)

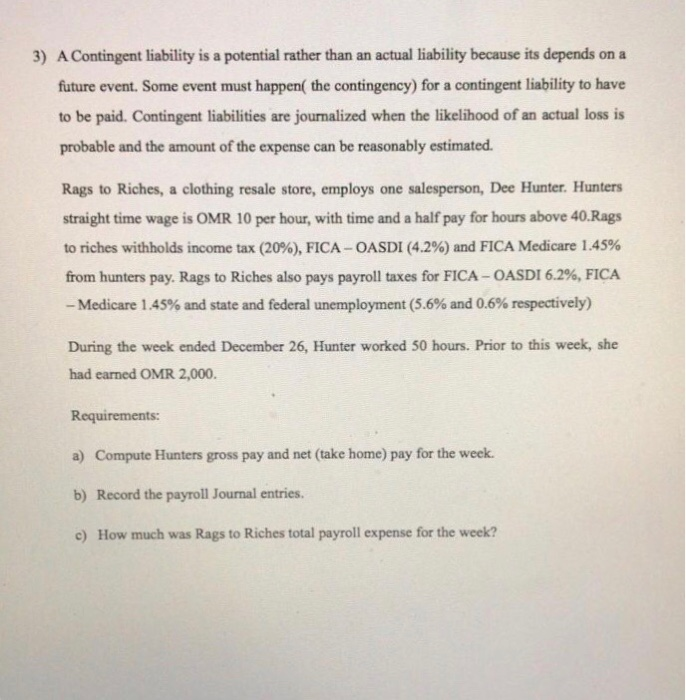

3) A Contingent liability is a potential rather than an actual liability because its depends on a future event. Some event must happen( the contingency) for a contingent liability to have to be paid. Contingent liabilities are journalized when the likelihood of an actual loss is probable and the amount of the expense can be reasonably estimated. Rags to Riches, a clothing resale store, employs one salesperson, Dee Hunter. Hunters straight time wage is OMR 10 per hour, with time and a half pay for hours above 40. Rags to riches withholds income tax (20%), FICA - OASDI (4.2%) and FICA Medicare 1.45% from hunters pay. Rags to Riches also pays payroll taxes for FICA - OASDI 6.2%, FICA - Medicare 1.45% and state and federal unemployment (5.6% and 0.6% respectively) During the week ended December 26, Hunter worked 50 hours. Prior to this week, she had earned OMR 2,000. Requirements: a) Compute Hunters gross pay and net (take home) pay for the week. b) Record the payroll Journal entries. c) How much was Rags to Riches total payroll expense for the week

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts