Question: 3. A couple is trying to decide whether to refinance their existing mortgage. They currently owe $131,000 and pay $715 a month with an annual

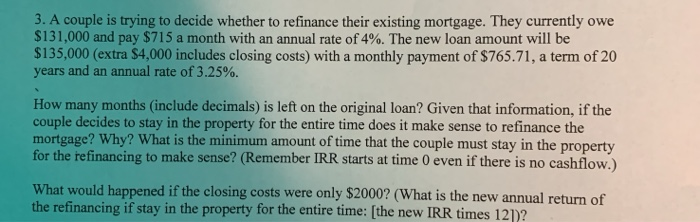

3. A couple is trying to decide whether to refinance their existing mortgage. They currently owe $131,000 and pay $715 a month with an annual rate of 4%. The new loan amount will be $135,000 (extra $4,000 includes closing costs) with a monthly payment of $765.71, a term of 20 years and an annual rate of 3.25%. How many months (include decimals) is left on the original loan? Given that information, if the couple decides to stay in the property for the entire time does it make sense to refinance the mortgage? Why? What is the minimum amount of time that the couple must stay in the property for the refinancing to make sense? (Remember IRR starts at time 0 even if there is no cashflow.) What would happened if the closing costs were only $2000? (What is the new annual return of the refinancing if stay in the property for the entire time: (the new IRR times 12])

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts