Question: 3. A developer wants to finance a project costing $1.5 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent.

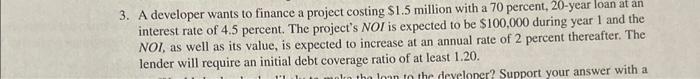

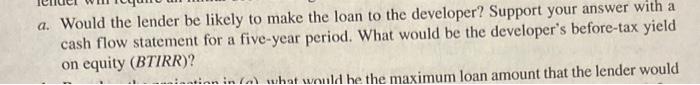

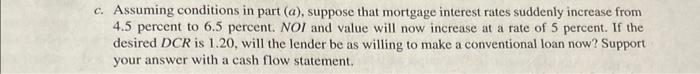

3. A developer wants to finance a project costing $1.5 million with a 70 percent, 20 -year loan at an interest rate of 4.5 percent. The project's NOI is expected to be $100,000 during year 1 and the NOI, as well as its value, is expected to increase at an annual rate of 2 percent thereafter. The lender will require an initial debt coverage ratio of at least 1.20. a. Would the lender be likely to make the loan to the developer? Support your answer with a cash flow statement for a five-year period. What would be the developer's before-tax yield on equity (BTIRR)? Assuming conditions in part (a), suppose that mortgage interest rates suddenly increase from 4.5 percent to 6.5 percent. NOI and value will now increase at a rate of 5 percent. If the desired DCR is 1.20, will the lender be as willing to make a conventional loan now? Support your answer with a cash flow statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts